Rate Cut Speculation, Fractal Bitcoin’s Launch & TON Activity

Fourth edition of the Ryze Roundup.

Market Commentary

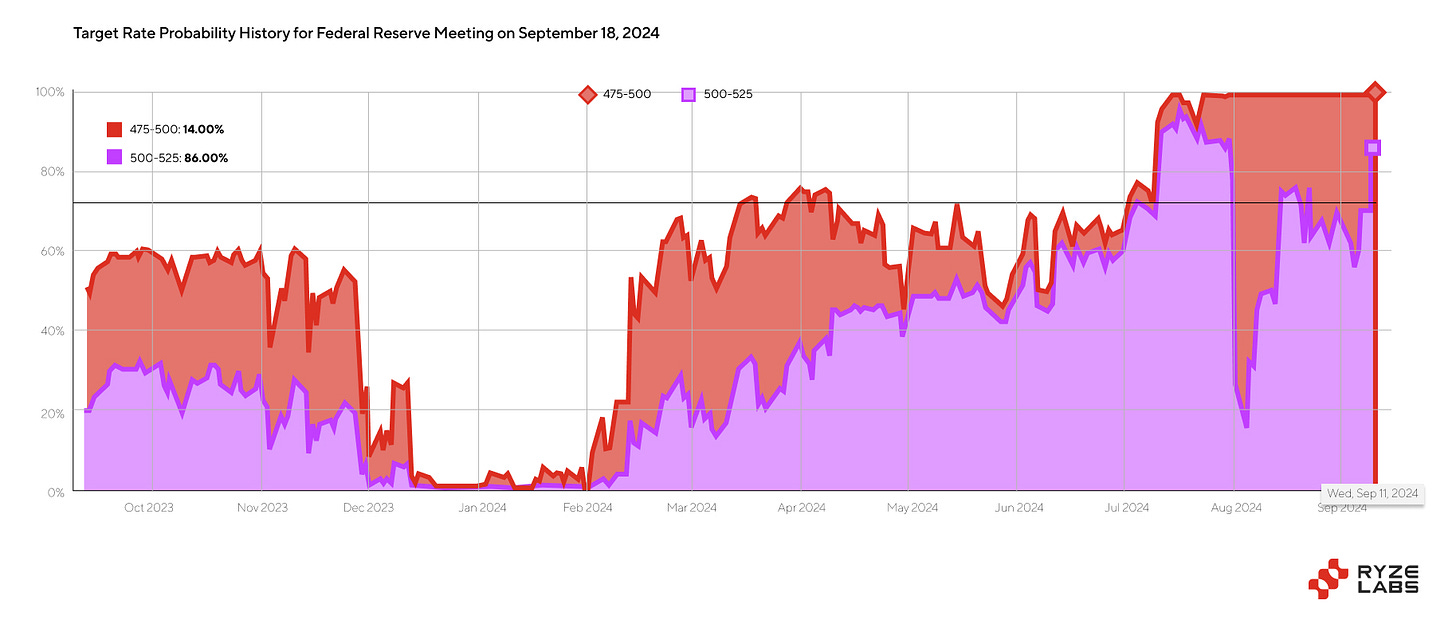

Last Friday, U.S. August Non-Farm Payrolls (NFPs) were reported at 142,000, falling short of the expected 165,000, while the unemployment rate matched expectations at 4.2%. Initially, markets responded positively to the easing inflation concerns. However, sentiment quickly shifted as attention turned to the reduced likelihood of a 50bps rate cut at the upcoming September FOMC meeting, driving BTC below $53,000.

Tuesday’s presidential debate offered little in terms of crypto-related discussion. However, Harris emerged stronger, with Trump appearing unsettled by her remarks. This was reflected in Harris' PredictIt odds of winning the election, which rose to 56%, according to PredictIt.

In Japan, the BOJ’s Nakagawa and Tamura delivered successive rounds of hawkish rhetoric, both reaffirming the need to control rising inflation. This raised concerns about another round of carry-trade unwinding, further dampening market sentiment.

“Unfortunately evidence for the American political bear scenario continues to accumulate as evidence for a Harris pro-crypto pivot remains scarce and the probability of Trump hijacking the industry for his own means (see World Liberty) increases. The industry may lose either way.” Matthew Graham, managing partner.

On Wednesday, U.S. CPI data aligned closely with expectations, diminishing the likelihood of a 50bps rate cut. The market is now firmly pricing in a 25bps rate cut at next Wednesday’s FOMC meeting.

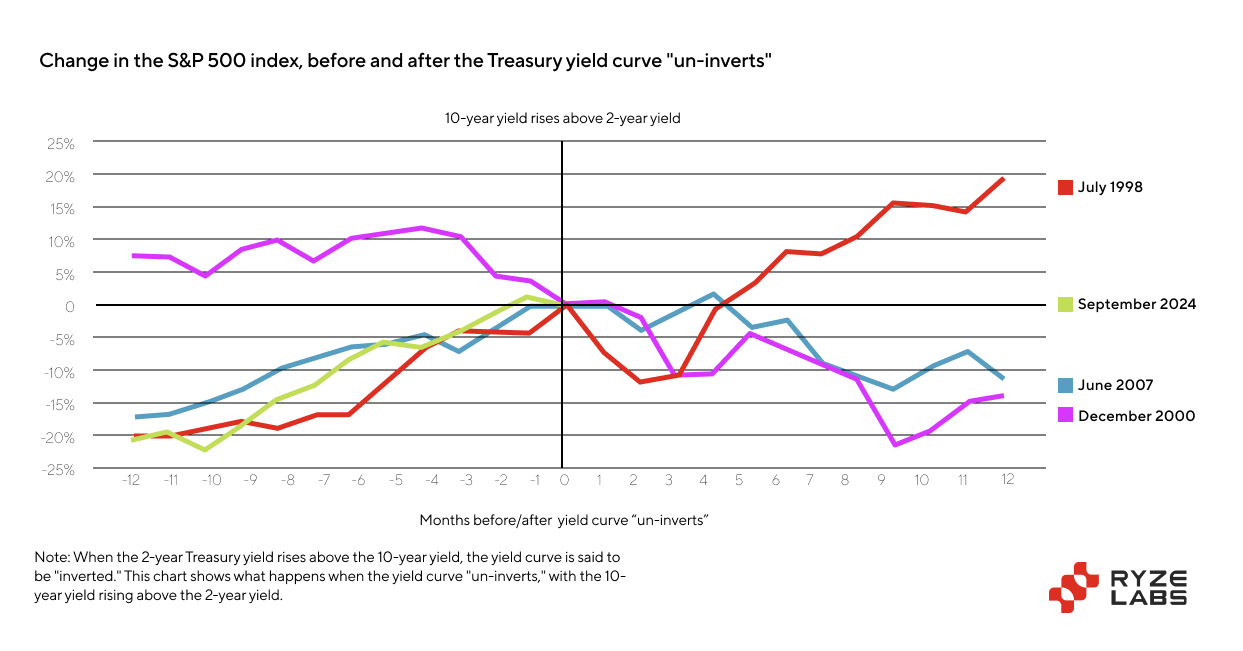

As the U.S. Treasury yield curve nears the end of its inversion, which began in 2022, we approach a critical juncture for risk assets. Historically, markets have struggled after the yield curve un-inverts, often signaling the onset of a recession. The key variable here is the state of the U.S. economy—if it remains resilient and avoids a recession, risk assets are likely to continue their upward trajectory. If not, then we’re in for a bumpy ride.

Key News & Events

Fractal Bitcoin: A New Approach to Bitcoin Scaling

On Monday, Fractal Bitcoin was launched, offering a novel method for scaling Bitcoin. Built on Bitcoin Core code, Fractal enables recursive scaling across unlimited layers. Within 24 hours, it captured over 40% of Bitcoin's hashrate through merge mining and 2% via permissionless mining, exceeding Bitcoin Cash's hashrate by threefold. The project maintains full compatibility with the Bitcoin mainnet while introducing features such as 30-second block times, hybrid mining, and OP_CAT support for Turing-complete smart contracts.

Fractal's market entry is supported by partnerships with UniSat, which has 1 million weekly active users, and OKX Wallet, ensuring a built-in user base at launch. The project focuses on transaction volume as its primary growth metric, rather than Total Value Locked (TVL). To encourage adoption, 1 million FB tokens were distributed to over 100,000 eligible addresses at launch. The project emphasizes decentralization in its ecosystem development, featuring diverse bridging solutions, open-source development, and a retroactive funding model for grants aimed at fostering impactful projects. Notable partnerships include sCrypt, F2Pool, and Nubit.

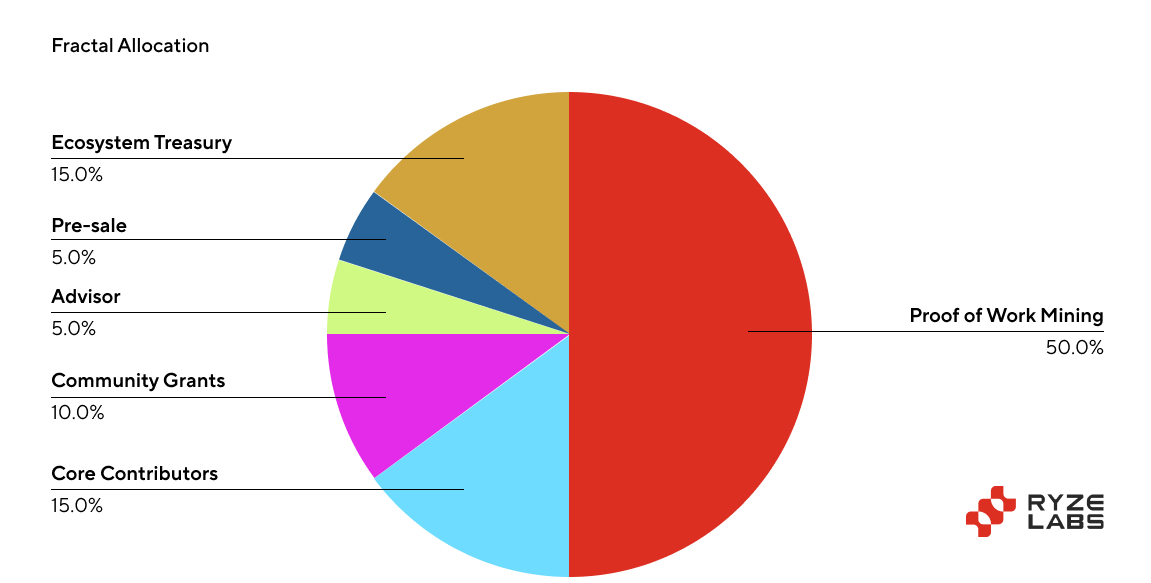

The tokenomics of Fractal are structured with long-term sustainability in mind, with a maximum supply of 210 million FB tokens, half of which are allocated to PoW mining. The project also incorporates strategic vesting and lock-up periods for various allocation categories. The teams behind Fractal include contributors from UniSat and Block Space Force, with members who have been active in the crypto industry since 2013, bringing considerable experience to the project.

However, Fractal faces several challenges. These include the programmability constraints of Bitcoin Script, technical risks associated with altering core Bitcoin parameters, and potential pushback from Bitcoin maximalists and proponents of existing Layer 2 solutions. Despite these hurdles, Fractal's distinctive approach and early adoption metrics indicate that it could play a significant role in Bitcoin's evolving utility and adoption. The project's progress will be an important area to monitor for its potential impact on the broader blockchain ecosystem.

“Fractal is an exceptional example of the importance of not limiting oneself to Western and/or English-language crypto information and relationship circles. While still fairly under the radar in the West, Fractal is making a big splash in Asia. Worth a watch.” Matthew Graham, managing partner.

For a more detailed analysis, please read here:

TON Roundup: Key Developments and Updates

Increased On-Chain Activity

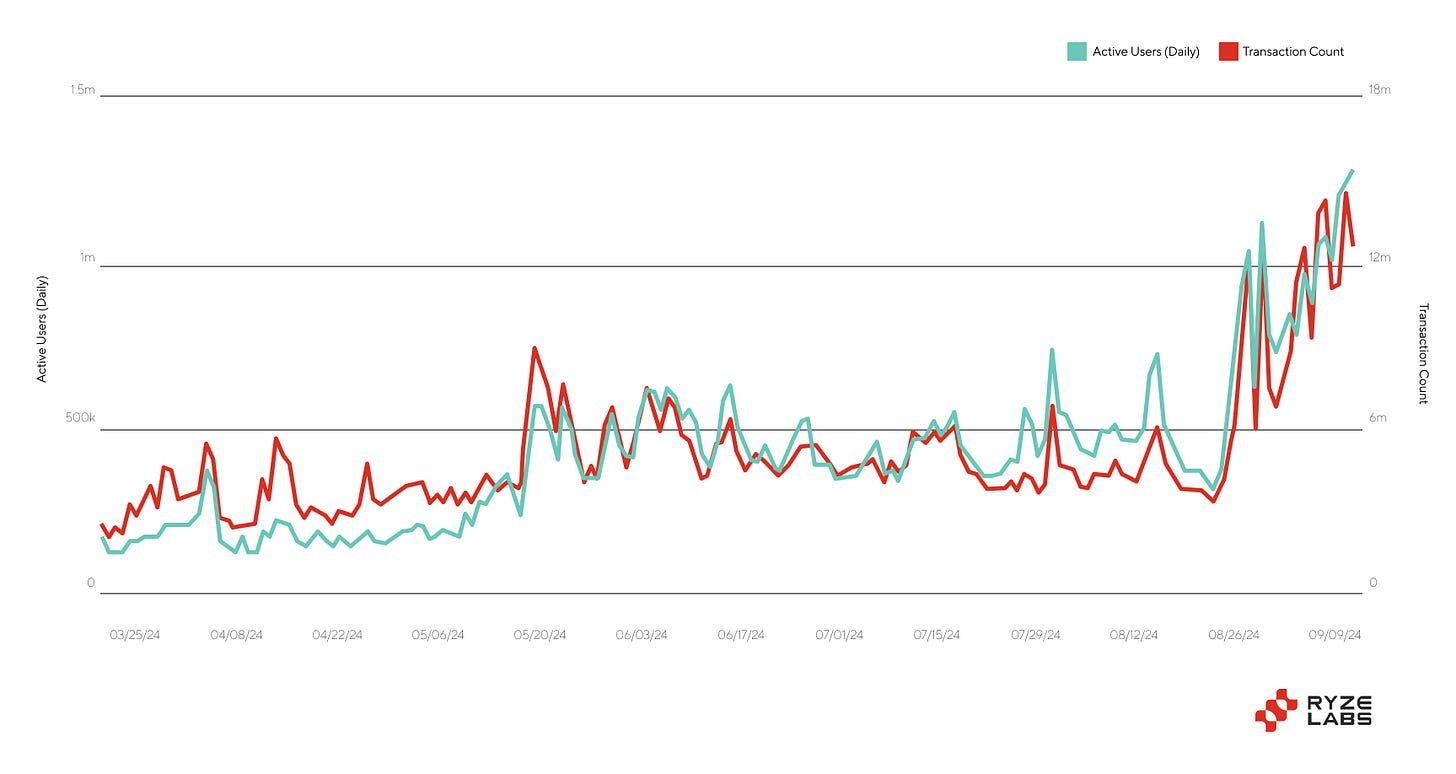

The TON blockchain has recently seen a significant rise in on-chain activity. Following the Token Generation Event of DOGS, daily transactions surged from 6 million to 12 million, setting a new baseline for September and October. Additionally, the number of daily active wallets has reached 1.2 million, marking a significant milestone for the network.

Revised Penalty System for Validators

On Monday, TON introduced changes to its validator penalty system. Validators processing less than 90% of expected blocks in a validation round are now subject to penalties. Each round lasts about 18 hours, with validator stakes remaining on the Elector smart contract for an additional 9 hours, during which on-chain complaints can be filed. The update aims to enhance the network’s stability and performance, especially after previous outages.

Complaints require 66% approval from validators by weight to impose penalties. The fine for poor performance is set at 101 TON, equivalent to a validator’s income per round, and is distributed among validators, with a portion rewarded to the complainant. The new system also addresses earlier issues where high network fees deterred complaint filings. Starting next Monday, an automated complaint sender will be active across several nodes. The penalty system remains decentralized, allowing any participant to file complaints, though enforcement requires validator quorum approval.

TADA Launches Telegram Mini App

TADA, a Southeast Asian ride-hailing platform, has partnered with the TON Foundation to launch aTelegram mini app that allows users to book rides directly through Telegram and pay with Toncoin or USDT on the TON blockchain. The goal is to integrate blockchain technology with everyday services, offering a seamless user experience without requiring additional app downloads or registrations. The TADA mini app will initially be available in Singapore, Thailand, Vietnam, and Cambodia, with plans to expand to Hong Kong by the end of the year.

Upcoming Token Launches

Two upcoming token launches are expected to further boost activity on the TON network. On September 20, CATI, the token for Catizen—a Telegram-based puzzle game with over 15 million monthly active users—will launch. The game allows players to merge and upgrade virtual cats to earn virtual KITTY, with the Catizen Foundation allocating 43% of the 1 billion CATI tokens to the community and ecosystem.

Following this, on September 23, the WAT token will be launched. Developed by Gamee, a subsidiary of Animoca Brands, WAT serves as a social reward mechanism within the GAMEE ecosystem. It enables users to earn WatPoints through daily tasks in the Telegram-based WatBird app and other mini-games. The WAT Protocol integrates with Ethereum, offering rewards through GMEE token staking and participation in Gamee’s Telegram games.

“The Pavel panic has receded and what remains is TON’s unique ability to onboard users en masse through its loose coupling with the Telegram ecosystem. A big month of token launches ahead.” Matthew Graham, managing partner.

The TON network is making significant progress with increased on-chain activity, improved stability through the updated validator penalty system, and practical applications like TADA’s ride-hailing mini app on Telegram, which bridges traditional services with blockchain technology. As upcoming token launches like CATI and WAT are expected to drive further engagement, these developments are likely to draw more web2 Telegram users onto the TON network.