Fractal Bitcoin: Comprehensive Research Report

Why Fractal Bitcoin is a disruptor to scaling Bitcoin and expanding its functionality.

by Joven Wu, Principal of Investment at Ryze Labs

TL;DR

Fractal Bitcoin, launched on September 9, 2024, could be another blind spot between Eastern and Western crypto markets. Despite quickly capturing a significant portion of Bitcoin’s hashrate, Fractal remains relatively unknown in the global crypto community. This report aims to bring clarity to this innovative project that has rapidly gained momentum within the Bitcoin ecosystem.

Key points:

Innovative Mining Approach: Fractal has introduced a hybrid mining model that combines merged mining with permissionless mining. This model presents a fresh perspective on Proof of Work (PoW), demonstrating that PoW remains a robust method for network security, even as the industry leans towards Proof of Stake (PoS).

Precursor Network for Bitcoin: Due to its compatibility with the Bitcoin mainnet, Fractal acts as a real-world test environment for developers, providing valuable user data and activity insights. The activation of OP_CAT on Fractal marks the beginning of numerous anticipated experiments, solidifying Fractal’s role as a proving ground for potential Bitcoin upgrades and innovations.

Strong User Base from Day One: By partnering with OKX and UniSat, Fractal has successfully engaged Bitcoin's most active users from the outset. This early adoption helps Fractal avoid the "cold start" issue that often challenges new platforms.

Grassroots and Community-Focused: Fractal maintains a down-to-earth, community-driven approach, steering clear of excessive hype and institutional influence. This focus on organic growth and engagement is central to its strategy.

Ecosystem Integration: Fractal has successfully brought together key players in the Bitcoin ecosystem, including communities around BRC-20, Ordinals, and Runes. This integration positions Fractal as a leader in current Bitcoin trends.

1. Introduction

Fractal Bitcoin is the only Bitcoin scaling solution that uses the Bitcoin Core code itself to enable recursive scaling across unlimited layers, building on the security and broad adoption of the world’s most trusted blockchain.

To fully appreciate Fractal's innovation, it's important to consider the historical context of Bitcoin scaling debates. In 2017, the SegWit soft fork was introduced to enhance Bitcoin’s block capacity, followed by the contentious Bitcoin Cash hard fork, which presented an alternative approach to scaling. Since 2018, attention has increasingly turned to Layer 2 solutions like the Lightning Network. Fractal emerges as a novel contender in this ongoing quest for better scalability and functionality in Bitcoin, offering a fresh approach to addressing these long-standing challenges.

In a significant milestone, Fractal's mainnet went live on Monday, September 9 at 00:00 UTC.

The project’s early success has been notable, with Fractal’s merge mining quickly accounting for over 40% of Bitcoin’s total hashrate, and its permissionless mining contributing an additional 2%. To put this in perspective, Fractal’s permissionless mining hashrate surpassed three times that of Bitcoin Cash (BCH) within just 24 hours of its launch. This rapid adoption indicates strong confidence in Fractal's technological capabilities and potential within the mining community.

Major players in the mining industry have already joined Fractal's ecosystem, including leading pools like F2Pool, Antpool, and Spiderpool. Additionally, several other prominent mining pools are poised to participate, reflecting the growing interest and potential for further expansion of Fractal's mining network.

2. Core Concept and Technology

2.1 Native Bitcoin Extension

Fractal distinguishes itself from other scaling solutions by being a native extension of Bitcoin. It leverages Bitcoin's existing codebase, making only necessary modifications to block production parameters. This ensures full compatibility with the Bitcoin mainnet, allowing for seamless integration with existing Bitcoin infrastructure. Fractal enhances Bitcoin’s functionality without compromising its core security principles, effectively balancing innovation with the preservation of Bitcoin’s foundational values.

2.2 Technical Specifications

Fractal introduces several key technical innovations:

Block Time: Fractal reduces the block time to 30 seconds, a significant improvement over Bitcoin’s 10-minute block interval. This faster block time allows for quicker transaction confirmations, greatly improving user experience and increasing the network's overall throughput. This enhancement makes Fractal suitable for a broader range of applications that require high transaction volumes.

Mining Mechanism: Fractal employs a unique hybrid mining approach. For every three blocks, two are mined through permissionless mining, and one is merged-mined with Bitcoin. This method promotes decentralization by allowing individual miners to freely participate in two-thirds of the block production while leveraging Bitcoin’s robust hash power for added security in the merge-mined blocks. This balanced approach maintains network security and decentralization while incentivizing existing Bitcoin miners to support the Fractal network.

Scalability: Fractal’s architecture is designed for recursive scaling, allowing for potentially unlimited layers of improvement. Each Fractal layer increases capacity by 20 times compared to the Bitcoin mainnet. This exponential scalability model addresses Bitcoin’s throughput limitations while preserving the security properties of the base layer.

Smart Contract Functionality: By implementing the OP_CAT opcode, Fractal enables Turing-complete smart contracts on a Bitcoin-based platform. OP_CAT, a simple concatenation operation, when combined with other opcodes, allows for the creation of complex smart contract logic. This functionality opens up possibilities for advanced DeFi protocols, complex NFT mechanics, and other decentralized applications that were previously limited to platforms like Ethereum.

Parallel Execution: Fractal's architecture allows different applications to run their own instances, enabling specialized optimizations without affecting the entire network. For example, gaming platforms could operate on dedicated Fractal layers optimized for high-frequency, low-value transactions, while DeFi protocols could utilize separate layers with parameters tuned for financial operations.

Compatibility: Fractal maintains 100% compatibility with Bitcoin standards such as BRC-20 and Ordinals. This ensures that existing Bitcoin-based tokens and NFTs can seamlessly operate on Fractal. Furthermore, users can use the same address across Bitcoin mainnet and Fractal, simplifying the user experience and reducing the risk of errors in address management.

Lorenzo, the founder of UniSat and core contributor to Fractal has summarized his vision in this reply to a question from the community。

2.3 Unique User Experience

Unlike other Bitcoin Layer 2 solutions, the wallet address on Fractal is exactly the same as the Mainnet address. This design mirrors the convenience found in Ethereum, where users simply toggle between networks within their wallets, such as UniSat or OKX Wallet, to access different layers. Unlike other Bitcoin Layer 2 solutions that require a separate EVM-based wallet address, Fractal allows users to retain their Bitcoin mainnet address for Layer 2 activities. As of today, major wallets like OKX Wallet and UniSat Wallet, which serve the majority of active Bitcoin DeFi and collectibles users, fully support Fractal Bitcoin.

3. Fractal in the Bitcoin Ecosystem

3.1 Comparison with Other Bitcoin Solutions

Fractal enters a competitive landscape of Bitcoin scaling solutions. Here's how it compares to some of the prominent alternatives:

EVM-compatible L2s: Several projects have attempted to create EVM based Layer 2 solutions for Bitcoin. While these solutions are relatively easy to implement and launch, they face a significant challenge in terms of acceptance within the Bitcoin community. The Bitcoin ecosystem, particularly its core users and developers, often view these EVM-compatible solutions as Frankenstein's monster. Fractal, by contrast, takes a Bitcoin-native approach, aiming to extend Bitcoin's capabilities without importing external architectures. This approach may resonate more strongly with Bitcoin purists and could lead to better integration and adoption within the existing Bitcoin ecosystem.

Bitcoin Cash (BCH): Bitcoin Cash emerged as a hard fork of Bitcoin, aiming to increase scalability through larger block sizes. This approach led to a contentious split in the Bitcoin community, effectively forcing users to choose between two competing visions of Bitcoin. The BCH fork introduced political debates that often overshadowed technical discussions. In contrast, Fractal takes a fundamentally different approach. Rather than creating a separate chain or forcing a choice, Fractal embraces Bitcoin as the main network and seeks to scale it natively. Fractal's architecture allows for the creation of multiple instances that can scale together, potentially offering unlimited scalability without compromising the base layer's security or decentralization.

Lightning Network: While Lightning excels at fast, low-cost payments and offers high privacy, it has limited smart contract functionality and faces channel liquidity challenges. Fractal, in contrast, offers full smart contract support and doesn't require channel management, potentially providing a simpler user experience.

3.2 Market Approach and Built-in User Base

Fractal stands out in the competitive Layer 2 landscape not just through its technical innovations, but also by leveraging a strategic market approach and a robust built-in user base. Supported by UniSat, a leading Bitcoin wallet with approximately 1,000,000 weekly active users (WAU), Fractal has a significant advantage in reaching a ready and engaged audience.

Many of these UniSat users already hold assets such as BRC20 tokens and Runes in their wallets. These users naturally desire a cheaper, faster, and more feature-rich environment for transactions. Fractal is positioned to meet this demand directly, providing an improved transaction experience while maintaining familiarity and compatibility with the Bitcoin ecosystem these users are accustomed to.

This built-in user base gives Fractal a significant edge over other Layer 2 solutions and new blockchain platforms that often struggle with the "cold start" problem – the challenge of attracting an initial user base and building network effects from scratch. Fractal, by leveraging UniSat's existing user base, can potentially bypass this early adoption hurdle.

Furthermore, Fractal's approach to growth metrics sets it apart from many other blockchain projects. While many Layer 2 solutions and new blockchains focus on Total Value Locked (TVL) as a key metric, Fractal is positioned to prioritize the number of transactions as its north star metric. This approach aligns well with its built-in user base, who are likely to generate transaction volume organically as they interact with their existing assets on a more efficient platform.

By focusing on transaction volume rather than TVL, Fractal can demonstrate real-world usage and adoption, which may be more attractive to both users and investors in the long run. This strategy also allows Fractal to differentiate itself in a crowded market where many projects compete primarily on TVL figures.

4. Ecosystem Building

Fractal's approach to ecosystem development is characterized by a strong commitment to decentralization and community-driven growth. This section outlines Fractal's strategy for fostering a robust and diverse ecosystem.

4.1 Decentralization Ethos

At the core of Fractal's ecosystem-building strategy is an unwavering commitment to decentralization. This ethos is reflected in several key aspects:

Diverse Bridging Solutions: Unlike some Layer 2 solutions that rely on a single, official bridge, Fractal encourages multiple bridging methods between mainnet and its network. This approach reduces single points of failure and fosters innovation in cross-chain interactions.

Open Development Environment: Fractal doesn't mandate specific development frameworks or methodologies, allowing developers to innovate freely within the ecosystem.

Community-Driven Governance: The ecosystem's direction is significantly influenced by community input and initiatives, rather than being dictated solely by a central authority.

Distributed Infrastructure: Fractal promotes a distributed approach to core infrastructure development, encouraging multiple parties to contribute to critical components of the ecosystem.

4.2 Bootstrapping Users and Builders

Fractal has implemented strategic programs to bootstrap both user adoption and developer engagement:

User Rewards Program: Upon mainnet launch, Fractal distributed 1M FB tokens to over 100,000 eligible addresses from OKX Wallet and Unisat Wallet users. This initiative created a wide holder base of FB tokens, setting the stage for increased participation in Fractal activities.

OKX Wallet Partnership: The successful collaboration with OKX Wallet demonstrates Fractal's ability to partner with major players in the cryptocurrency space, significantly expanding its potential user base.

Builder Incentives: Through various grant programs and developer resources, Fractal incentivizes builders to contribute to the ecosystem's growth.

4.3 Grant Program and Project Evaluation

Fractal's grant program is designed to support and incentivize projects that contribute to the ecosystem's growth and align with its decentralization ethos:

Retroactive Funding Model: Fractal employs a retroactive funding approach, rewarding projects based on demonstrated impact rather than speculative promises. This model encourages high-quality work and tangible outcomes.

Evaluation Criteria: Projects are assessed based on their contribution to the ecosystem, technical innovation, alignment with Fractal's decentralization principles, and potential for long-term impact.

Diverse Project Types: The grant program supports a wide range of projects, from core infrastructure development to application-layer innovations, ensuring a well-rounded ecosystem.

4.4 Highlighted Grant Recipients

Several key projects have already received support through Fractal's grant program:

sCrypt: Enhancing Fractal's scripting capabilities, enabling complex smart contracts on the Bitcoin network.

F2Pool: A major mining pool contributing to Fractal's security and providing critical feedback on mining functions.

Nubit: Developing a data availability (DA) layer to support scalable applications, including Ordinals and Layer 2 solutions.

DeTrading: Enabling cross-chain atomic swaps without central authorities or collateral, simplifying trustless trading on Fractal.

UniWorlds: Pioneering immersive environments on Fractal, developing community and game toolkits for building inter-communicable virtual worlds.

FractalEcosystem.io: A community-driven directory showcasing Fractal projects, enhancing transparency and discovery within the ecosystem.

4.5 Future Outlook

Looking ahead, Fractal is poised for continued ecosystem growth and innovation:

Expanding Grant Programs: The upcoming Season 1 Retroactive Grants Program (September 9 to October 9, 2024) will further accelerate ecosystem development.

Community Engagement: Planned community bounties and the establishment of a Community Council in Q4 2024 will deepen community involvement in ecosystem direction.

Potential Use Cases: Fractal's architecture supports a wide range of future applications, including advanced DeFi protocols, enhanced NFT functionality, enterprise solutions, and decentralized identity systems.

Scaling Infrastructure: As the ecosystem grows, Fractal will continue to support the development of scalable infrastructure to accommodate increasing network activity.

Cross-Chain Interoperability: Future developments may focus on enhancing interoperability with other blockchain ecosystems, expanding Fractal's reach and utility.

5. Tokenomics and Economic Model

Fractal has designed a comprehensive tokenomics model aimed at ensuring long-term sustainability while maximizing value for the community and investors. The model is structured to incentivize all participants in the ecosystem, from miners to developers, fostering a shared interest in the network's growth and success.

5.1 Token Details

Name: FB (Fractal Bitcoin)

Max Supply: 210 million coins

Total Supply: 105153225.00000000

Circulating Supply: 1213225.00061300

Primary Use Case: Transaction fees within the Fractal ecosystem

Secondary Use Case: Voting, Applications

5.2 Token Allocation

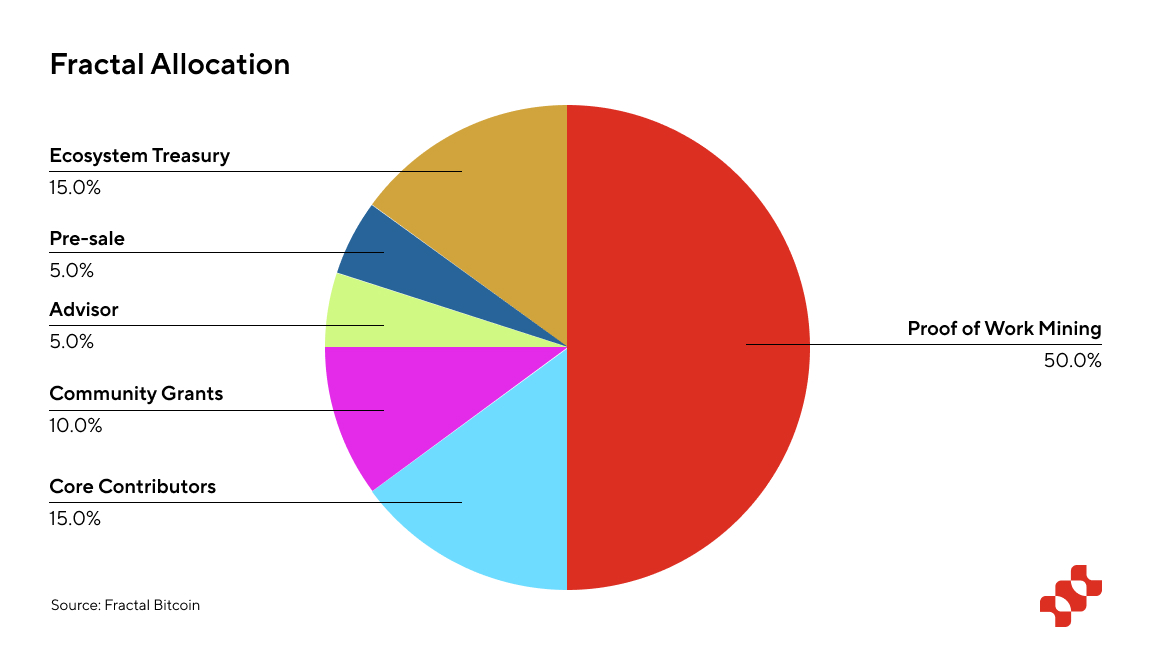

Fractal's token distribution strategy is carefully designed to promote network security, incentivize growth, and reward key contributors across the ecosystem. The allocation is as follows:

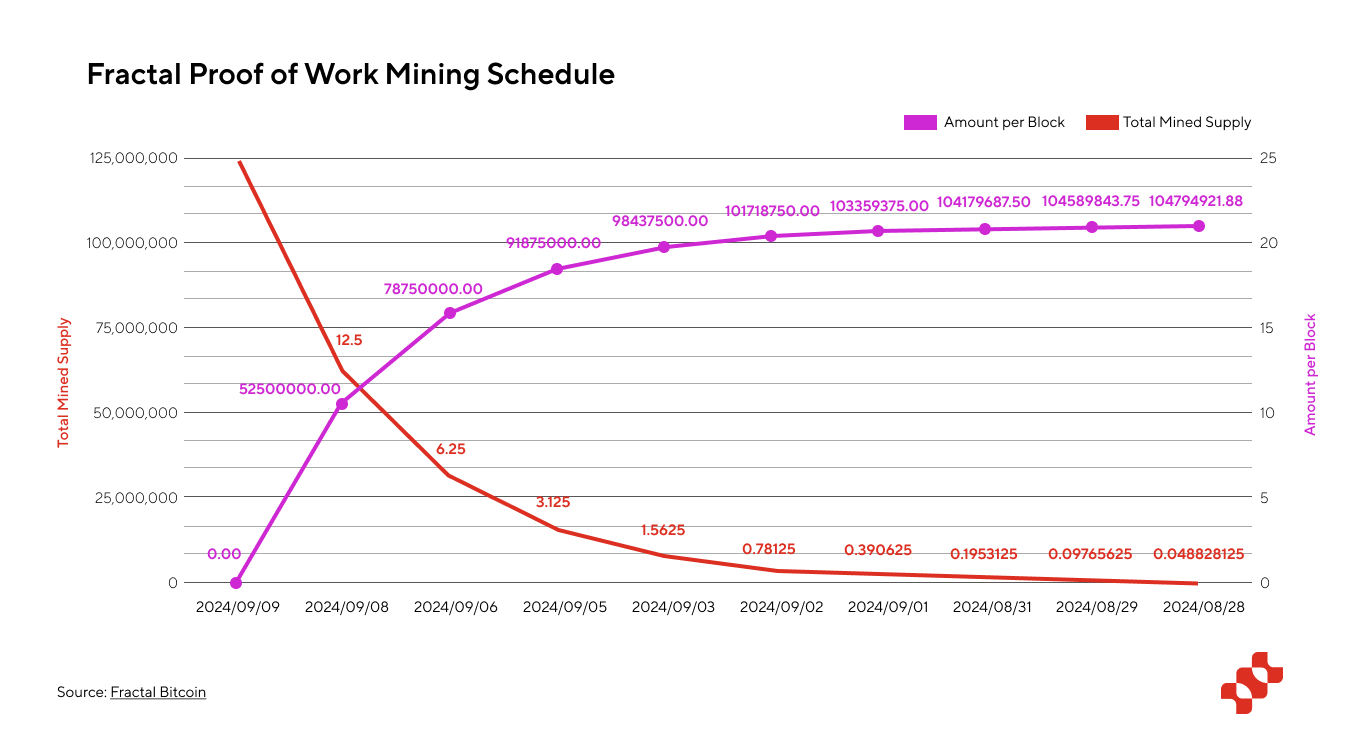

Proof of Work Mining (50%): Half of the total token supply is allocated to Proof of Work (PoW) mining. This significant allocation aligns Fractal closely with Bitcoin's security model, ensuring network security and reliable block production.

Ecosystem Treasury (15%): This portion is reserved for investing in the Fractal ecosystem. It will support and fund initiatives that improve the ecosystem and provide for ongoing core improvements to Fractal. A maximum of 10% of this pool may be used each year, over a period of 10 years.

Community Grants (10%): Allocated to establish partnerships and liquidity programs. These community-directed initiatives aim to boost network engagement over time. Similar to the Ecosystem Treasury, a maximum of 10% of this pool may be used each year, over a period of 10 years.

Pre-sale (5%): This allocation targets early investors and is crucial for covering initial development and operational costs, as well as conducting security audits. These tokens are subject to a lock-up period of seven months, followed by a linear release until the twelve-month mark.

Advisor (5%): Reserved for present and future advisors who will provide strategic advice and support for Fractal's ongoing development. A maximum of 20% of this pool may be used each year, over a period of 5 years.

Core Contributors (15%): Allocated to those who build and maintain Fractal's core software. These tokens are subject to the same lock-up and vesting schedule as the presale tokens.

5.3 Vesting and Lock-up Periods

To ensure long-term commitment and align interests:

Pre-sale and Core Contributor tokens are locked for seven months, followed by a linear release until the twelve-month mark.

Ecosystem Treasury and Community Grants have a controlled release of a maximum of 10% per year over 10 years.

Advisor tokens have a controlled release of a maximum of 20% per year over 5 years.

5.4 Transparency and OP_CAT based Governance Voting Mechanism

Fractal is committed to transparency and has published the official addresses for each token allocation category, which will be trackable upon mainnet launch. This allows the community to monitor how tokens are distributed and utilized, ensuring accountability throughout the process.

Fractal also actively encourages community participation in governance. Users are invited to contribute ideas and feedback as the project evolves, with proposals ranging from protocol upgrades and parameter adjustments to decisions on fund allocation from the Ecosystem Treasury or Community Grants pool. This inclusive approach ensures that Fractal remains adaptable and responsive to the community's needs and market dynamics.

To further enhance community governance, Fractal plans to implement an OP_CAT-based voting mechanism, a first in the Bitcoin space. This innovative system will enable Fractal token holders to vote on proposals directly within the ecosystem, utilizing the capabilities of OP_CAT to create a secure and efficient governance process.

6. Team and Partnerships

6.1 Core Contributors

Fractal Bitcoin is built by a consortium of experienced teams in the Bitcoin ecosystem:

UniSat: As a leading Bitcoin wallet with over 900,000 weekly active users, UniSat brings significant experience in user interface design for cryptocurrency applications, implementing and supporting Bitcoin standards like BRC-20 and Ordinals, and managing high-value digital assets securely. Their involvement lends credibility to the project and provides a potential large user base for early adoption.

Block Space Force: The co-founders have a track record of building and scaling world-class ventures like Coinbase, CoinMarketCap, and Cobo. They have invested in 100x projects and navigated 9-figure exits. This suggests expertise in scaling blockchain projects from concept to mass adoption, and navigating regulatory challenges in the space.

6.2 Developer Platform Partnerships

Fractal has strong support from Scrypt, a team building a smart contract metaprotocol on Bitcoin using OP_CAT. This partnership could lead to significant synergies, including collaborative development of advanced smart contract standards, shared security audits and best practices, and cross-promotion and ecosystem-building efforts.

7. Challenges and Risks

While Fractal presents an innovative approach to scaling Bitcoin and expanding its functionality, it also faces challenges that potential investors and users should consider:

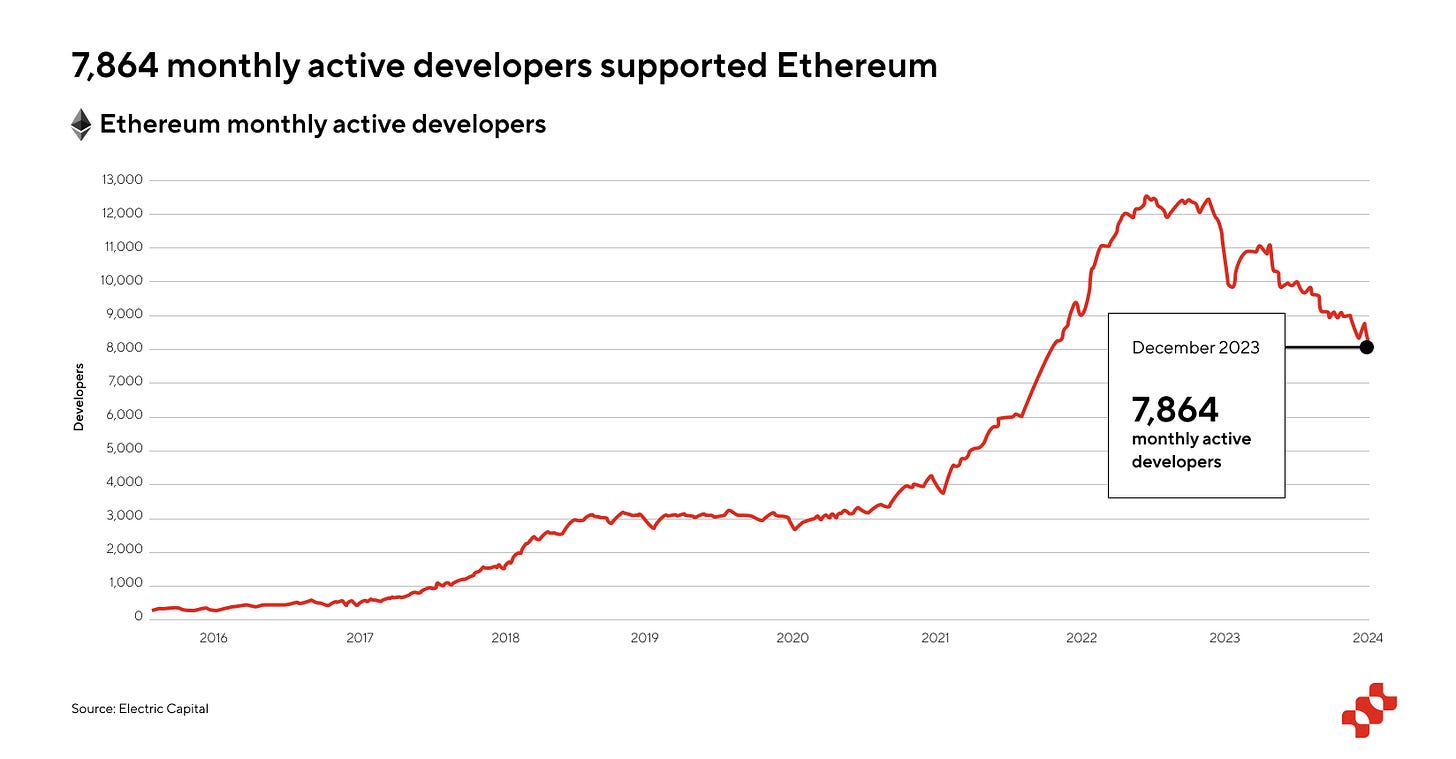

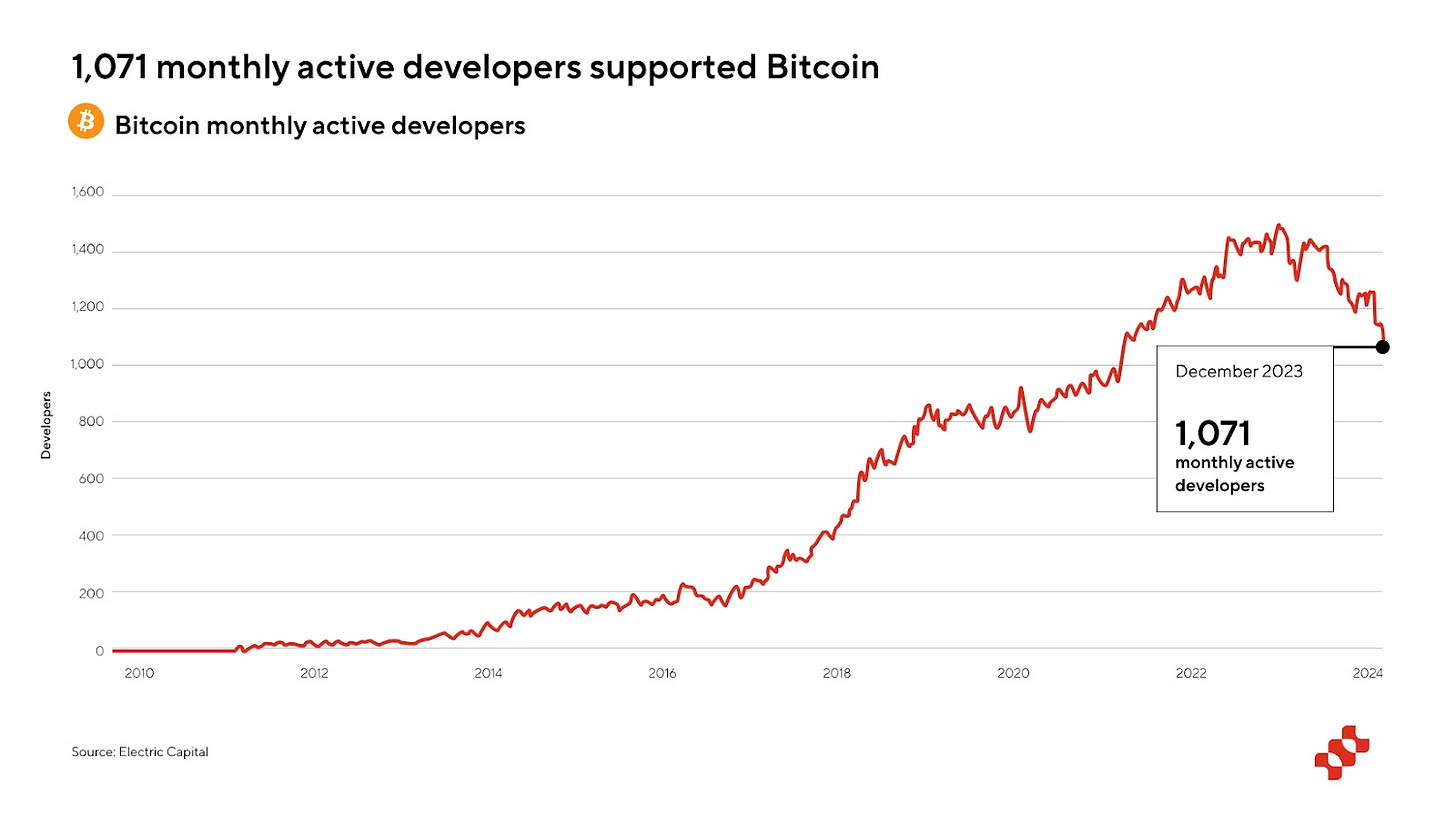

Programmability emerges as a primary challenge for Fractal. Due to its 100% compatibility with Bitcoin mainnet, Fractal is programmed using Bitcoin Script, which could present hurdles for ecosystem growth. To put things in perspective, there are 1071 Monthly Active Developers in Bitcoin according to the Electric Capital developer report compared to 7864 Monthly Active Developers in Ethereum.

Bitcoin Script is less widely known and potentially more challenging to use than popular smart contract languages like Rust or Solidity, likely resulting in a smaller pool of capable developers. The higher barrier to entry for coding on Fractal, combined with potentially limited functionality compared to other blockchains, may slow down ecosystem expansion. Furthermore, the relative immaturity of development tools, libraries, and frameworks for Bitcoin Script compared to other blockchain environments could further impede rapid application development and deployment on Fractal.

Technical risks also present significant challenges. Modifying core Bitcoin parameters and implementing new features like OP_CAT carry inherent risks of introducing vulnerabilities or unintended consequences. The complexity of managing recursive scaling and multiple layers adds another dimension of technical challenge.

Adoption risks pose another significant challenge. Fractal may face resistance from Bitcoin maximalists who view any modification or extension of Bitcoin as unnecessary or potentially harmful. Convincing users and developers to switch from established Layer 2 solutions or other blockchain platforms could prove difficult, especially given the network effects these existing solutions have built. Additionally, the Runes, Ordinals, and BRC-20 communities may be reluctant to adopt the same standards on Fractal, despite its compatibility. These communities have already established ecosystems and may see limited incentive to migrate or expand to a new platform, even if it offers improved performance. Fractal will need to clearly articulate its value proposition and potentially offer significant incentives to drive initial adoption across all these user segments. The challenge lies not only in providing technical superiority but also in overcoming the inertia of established communities and their existing investments in current platforms.

To address these challenges, particularly the programmability issue, Fractal may need to invest heavily in developer education, create robust development tools, and potentially explore ways to make the development process more accessible without compromising its core integration with Bitcoin.

8. Conclusion

Fractal Bitcoin represents a groundbreaking approach to scaling Bitcoin and expanding its functionality. As the only Bitcoin scaling solution that uses Bitcoin Core code itself to recursively scale unlimited layers, Fractal offers a unique value proposition in the competitive landscape of Layer 2 solutions.

Key strengths of Fractal include:

Native Bitcoin Integration: Fractal maintains full compatibility with Bitcoin mainnet, ensuring seamless integration with existing infrastructure while enhancing functionality.

Technical Innovations: With its 30-second block time, hybrid mining approach, and support for OP_CAT, Fractal significantly improves transaction speed and enables complex smart contracts on a Bitcoin-based platform.

Built-in User Base: Fractal has a significant advantage in overcoming the "cold start" problem that plagues many new blockchain platforms. Backed by UniSat wallet with a million weekly active users, Fractal starts with a strong foundation. This is further bolstered by the Fractal Mainnet Bootstrap Program, which has resulted in 100,000 active addresses holding FB tokens, representing some of the most engaged Bitcoin users. Additionally, OKX Wallet's full integration with Fractal opens up access to millions of potential users from the OKX ecosystem.

Strong Mining and Network Security: 30-40% of Bitcoin Hashrates via Merge Mining and 1-2% of Bitcoin Hashrates via Solo Permissionless Mining.

Ecosystem Development: Through strategic grant programs and community initiatives, Fractal is actively fostering a diverse ecosystem spanning DeFi, gaming, and core infrastructure development.

Unique User Experience: Fractal's approach allows users to use the same address across Bitcoin mainnet and Fractal, providing an Ethereum-like experience for network switching.

Strong Team with Long-Term View on the Space: The core contributors to Fractal have been building in Bitcoin and the crypto industry since 2013. This helps the team to adopt a significant long-term view of the industry to move Fractal to a wider audience.

However, Fractal also faces significant challenges:

Programmability: The use of Bitcoin Script may present a barrier for developers more familiar with languages like Solidity or Rust.

Technical Risks: Modifying core Bitcoin parameters and implementing new features like OP_CAT carry inherent risks.

Adoption Hurdles: Convincing users and developers to switch from established solutions may prove challenging.

Despite these challenges, Fractal's innovative approach, strong backing, and early traction in mining adoption suggest significant potential. The project's success in attracting major mining pools and its rapid hashrate growth post-launch are particularly encouraging signs.

As the ecosystem continues to evolve, Fractal is positioning itself as a platform for innovative Bitcoin-based applications across various sectors, potentially reshaping the landscape of Bitcoin utility and adoption. The planned implementation of an OP_CAT based governance voting mechanism further underscores Fractal's commitment to innovation within the Bitcoin ecosystem.

While the road ahead contains both opportunities and obstacles, Fractal Bitcoin represents a bold step forward in Bitcoin's scaling journey. Its success could have far-reaching implications for the future of Bitcoin and the broader blockchain ecosystem. As with any emerging technology, potential investors and users should carefully weigh the project's potential against its risks, keeping a close eye on its technological development, ecosystem growth, and market adoption in the coming years.

Great report! Learned a lot