What Does the Future of Global Trade Finance Look Like?

As the debate around currency denominations in global trade intensifies, what lies ahead for the US dollar?

by Eric Nemeth, investment associate

"Every night I ask myself why all countries have to base their trade on the dollar," President Lula said in a speech at the New Development Bank in Shanghai. "Why can't we do trade based on our own currencies?"

Many other nations have been wondering the same thing and some have even brokered agreements to denominate trade in other currencies, paving way for nations to potentially form their own economic blocs.

The topic has similarly prompted widespread discussions within the United States about the importance of the US Dollar to be the operating system of the global financial system and protecting the US' economic hegemony, something I wrote about in one of my last pieces.

What we are witnessing in the global economy is an attempt to denominate trade in other countries' assets to solve currency misalignments arising from tightening US policy decisions passing along the burden of a more expensive US Dollar to the rest of the world.

What I’ll cover

First, this essay will give an overview of the global trade imbalances which make shifting the redenomination of global trade actually more burdensome for the world.

Second, in this paradigm of fragmenting global trade into other currencies, there will potentially be increased transaction costs, as businesses will need to deal with multiple currencies, exchange rate risks, and higher financing costs. Third, and related to the second point, the potential disruption of cross-border payments arising from fintechs utilizing blockchain to instantly settle value in tandem with arbitrary data pertaining to real-world assets.

Global Trade Imbalances

How did we get here? Some background.

Much of the world is powered by the US Dollar as the United States is able to run current account deficits for the past five decades, meaning the US has been importing more value than it has been exporting. What this structurally means is that the US has demand for goods that it does not produce at home so it must export dollars in exchange for the import of goods.

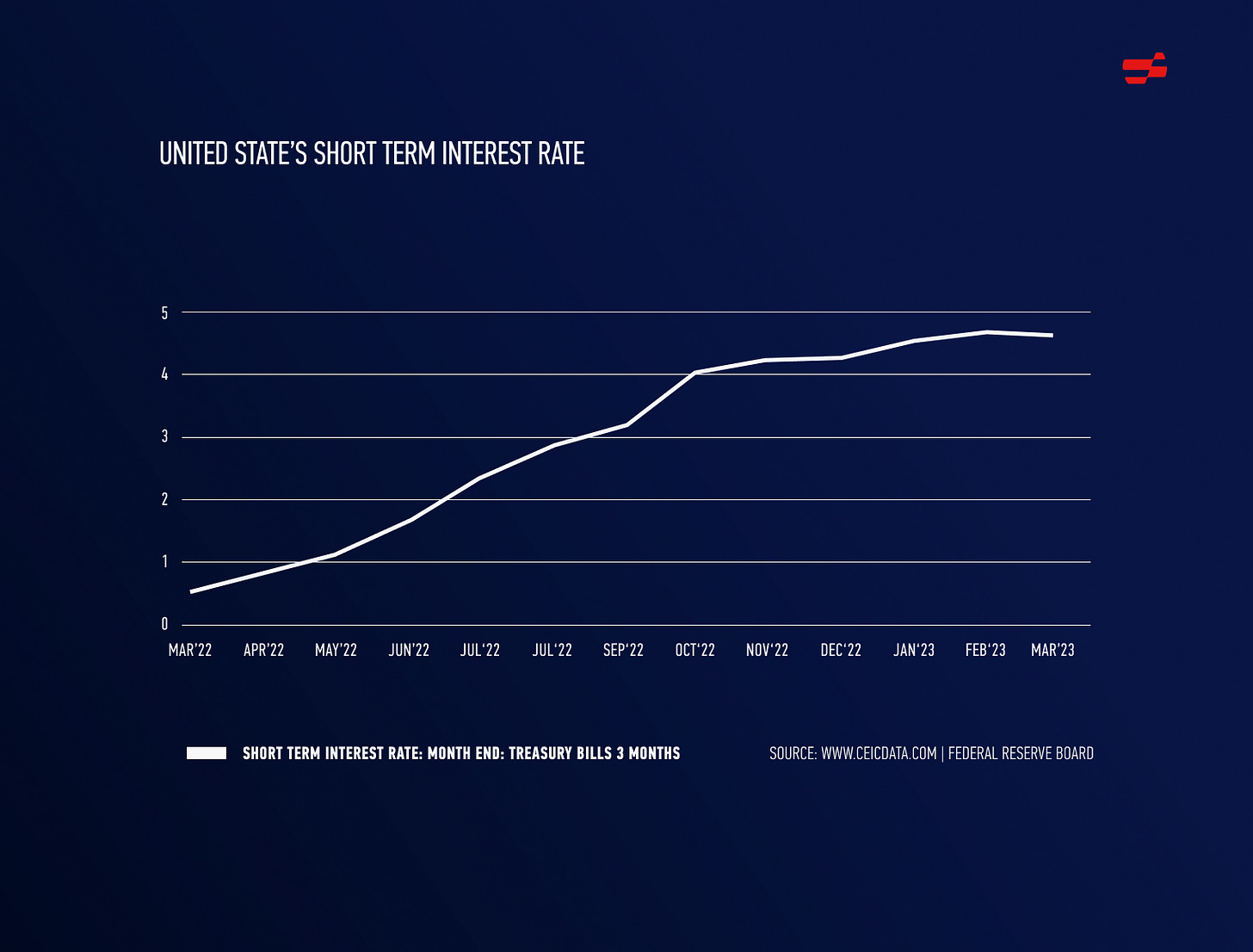

The reason emerging markets have become more pronounced in considering how to reduce their dependence on the US dollar is because of the tightening of monetary conditions in the US which has made dollars more expensive for the rest of the world. This, and the US sanctions in response to Russia's invasion of Ukraine, has led emerging nations to consider how to build an independent financial system without the US.

For developing nations to build this independent financial system, these economies will have to run permanent current account deficits which is structurally impossible and unattractive given the composition of global trade today. As Michael Pettis points out, "A country can only import net foreign savings by exporting ownership of assets, and the United States and other similar economies are the only stable, mature economies that are both willing and able to allow foreigners unfettered access to the acquisition of local assets."

Since these economies are relatively immature compared to the developed nations, they will not want to run current account deficits as this would mean they would need to open up their economy to foreigners to acquire their assets. And since developing countries would not want to allow or increase foreign investment into their economy, there are no economies in the world that would like to take the US' role in the world for being the absorber of other nation's current account surpluses.

Implications and Challenges

Denominating trade in other currencies and reducing dependence on the US dollar can have significant implications and challenges for the global economy. One of the key challenges is the potential for increased volatility in currency exchange rates. If trade is denominated in multiple currencies, it may lead to fluctuations in exchange rates and fragmented liquidity in the foreign exchange markets, which can create uncertainty and risks for businesses engaged in international trade.

Another challenge is the potential impact on global financial stability. If other currencies start to play a more prominent role in global trade, it may lead to a fragmentation of the global financial system, with different countries or regions having their own currencies as the dominant medium of exchange. This could create challenges in terms of coordination, regulation, and stability of the global financial system.

Moreover, building an independent financial system without the US dollar would require significant infrastructure and institutional changes, which could take time and resources to implement. More importantly, as discussed before, these developing nations will have to structurally evolve their economies to consume more than their nation saves, which is a tough ask considering the weak domestic demand across these nations.

Developing nations would need to establish mechanisms for clearing and settling transactions in their local currencies, as well as develop deep and liquid markets for their currencies to be widely accepted in global trade. This would require investments in technology, infrastructure, and financial market development.

How would this impact global finance?

If we truly begin to see more trade become denominated in other currencies, either by the behest of the United States to reduce its 'exorbitant burden' or by BRICs seeking to decrease their reliance and risks in trade being denominated in US Dollar, there would be profound impacts on how global finance would function.

In an essay examining the microstructures of the financial system, Elham Saeidinezhad discusses how derivative markets play a key role in risk distribution within the financial system by separating the flow of risks from the flow of collaterals. More importantly, Elham covers how derivatives directly link financialized commodity markets to the rest of the financial system.

Commodities

Directly on the topic of commodities, as that is what comprises much of the developing nations current account surpluses, denominating this trade in a different currency would require a significant overhaul of the existing financial infrastructure and management of this trade.

For example, if a nation with a current account surplus decides to change the denomination of its trade finance from one currency to another, it may require adjustments in collateral management processes by financial firms to match assets and liabilities or accept different types of collaterals. This could impact the willingness to pay for securities, the type of securities acquired, and the overall market structure.

Derivative Markets

Additionally, changes in trade finance denomination could affect derivative markets, as they depend on currency and commodity prices, and may lead to fluctuations in collateral values, funding conditions, and liquidity risks in the financial system. Understanding the implications of such changes in the collateral chain and how they may affect the stability of the financial system requires considering the industrial organization of various actors involved, including financial firms, institutional investors, and market makers.

Blockchains: A solution?

If these nations seriously want to consider going down this path, there could be interesting architectural designs of this infrastructure by using blockchain as the ledger of record and using smart contracts for the flow of payments, the flow of risk, clearing, and settlement.

Blockchain could provide transparency, security, and efficiency in clearing and settlement processes, and smart contracts could enable automated and programmable transactions with embedded logic for regulatory compliance. This could potentially streamline trade finance, reduce intermediaries, and increase accessibility, particularly for developing nations with current account surpluses from commodities.

The reason why blockchain could be interesting from this perspective is that it's the only technology that could do multi-lateral cross custodian clearing and settlement without the risks of a financial intermediary. The desire to avoid the risks of financial intermediaries is the primary reason for institutions to transact and deal directly with their counterparties.

Emerging Markets

For developing nations with current account surpluses from commodities, a blockchain-based clearing and settlement network could offer several benefits. It could simplify collateral management processes, as smart contracts could be used to automatically match assets and liabilities or accept different types of collaterals. This could streamline the management of collateral in trade finance, potentially reducing costs and improving efficiency.

Moreover, a blockchain-based clearing and settlement network could increase accessibility for developing nations, as it does not require extensive infrastructure or intermediaries to operate. This could provide an opportunity for these nations to participate more directly in global trade finance, reducing reliance on traditional financial systems and potentially increasing their bargaining power.

Conclusion

The redenomination of global trade away from the US dollar to other currencies presents both challenges and potential implications for the global economy. While some countries may seek to reduce their dependence on the US dollar due to tightening US policy decisions and economic sanctions, building an independent financial system without the US dollar would require significant infrastructure and institutional changes, as well as the establishment of mechanisms for clearing and settling transactions in local currencies and the development of deep and liquid markets for those currencies.

This could potentially lead to increased volatility in currency exchange rates, fragmented liquidity in foreign exchange markets, and challenges in terms of coordination, regulation, and stability of the global financial system. Moreover, the shift away from the US dollar could impact global finance, particularly in derivative markets and financialized commodity markets.

As the debate continues about the future of global trade and the role of different currencies in international transactions, it is clear that any significant shift away from the US dollar would have far-reaching consequences. It would require careful planning, coordination, and investment in infrastructure and institutions to ensure a smooth transition and mitigate potential risks.

Only time will tell how the global economy evolves in terms of currency denominations for trade, but it is certainly a topic that will continue to shape discussions and debates in the years to come.