Executive Summary

The Open Network (TON) combines a layer 1 blockchain with a suite of network protocols, forming a decentralized platform akin to a version of the internet. Developed initially by Nikolai Durov and advanced by a community of open-source developers, TON supports a diverse range of applications, including digital finance and decentralized storage. Its architecture, featuring a masterchain and multiple workchains, enhances scalability and supports high-volume transactions and complex operations across the network.

TON's development includes the Fragment platform, a decentralized marketplace that has processed over $350 million in transactions, demonstrating the network's functional and economic capabilities. Integration with Telegram has facilitated new methods for content monetization and audience engagement, leveraging the platform's widespread use. Recognition in the UAE and partnerships with major tech entities have broadened TON's global reach and influence.

As TON continues to evolve, its role in transitioning users to decentralized networks becomes increasingly vital. The network’s ability to handle substantial transaction volumes and support diverse applications positions it to potentially lead in blockchain innovation. With strategic initiatives underway and a growing adoption rate, TON aims to enhance the efficiency and security of digital transactions globally, contributing to the broader adoption of blockchain technology.

Introduction

The Open Network (TON) is a decentralized computer network consisting of a layer 1 blockchain (the TON blockchain) and a suite of network protocols (the TON network) that support the blockchain as well as being a stand alone decentralized network. It was originally developed by Nikolai Durov, who co-founded Telegram messenger with his brother Pavel in 2013.

History of Telegram & TON

The Durov brothers founded Telegram in 2013 with the mission “to provide a secure means of communication that works everywhere on the planet.” Before Telegram, the tech entrepreneurs were already well known for founding VKontakte (VK), a popular Russian social media platform similar to Facebook. Pavel Durov, the CEO of VK, was ousted from the company by investors in 2014 amid claims of pressure from the Russian government to hand over user data and censor political content on the platform. Following this, the brothers left Russia to focus on developing Telegram, emphasizing user privacy and security.

Telegram quickly gained popularity due to its focus on speed and security, amassing over 200 million monthly active users by March 2018. Up to then, Telegram was largely funded by Pavel via his Digital Fortress fund. Needing external capital to fund growth, while determined to keep the platform independent and free from external influence after lessons learned at VK, the Durov brothers explored various funding methods. In 2018, they launched the Telegram Open Network, intending to create a decentralized blockchain platform with its cryptocurrency, Gram. The initial coin offering (ICO) for TON raised $1.7 billion from private investors. However, the SEC intervened in October 2019, suing Telegram for conducting an unregistered securities offering. The SEC's action led to a protracted legal battle, resulting in Telegram abandoning the TON project in May 2020 and agreeing to return $1.2 billion to investors and pay an $18.5 million civil penalty.

This was not the end for TON, however. The code was separated from Telegram and open-sourced and the remaining testnet tokens were sent to smart contracts that allowed anyone to participate in future mining. Subsequently, a small team of open-source developers, led by Anatoliy Makosov and Kirill Emelyanenko, resumed active development. It was renamed to Toncoin and eventually TON, receiving full endorsement from Pavel Durov.

TON Components

The Open Network consists of network and storage components that amount to an impressive decentralized networking and web stack in its own right. The Open Network consists of the following core components:

TON Blockchain: A blockchain of blockchains - A masterchain, its workchains, their shardchains and finally their vertical blockchains.

TON Network: A P2P network used for communicating with / accessing the network.

TON Proxy: A network proxy/anonymization layer akin to TOR / I2P, used to hide the identity and IP address of nodes.

TON DNS: A predefined service, which uses a collection of smart contracts to keep a map from human-readable domain names to accounts, smart contracts, services and network nodes. Used to register and manage .ton domain names.

TON Sites: Allows users to build a decentralized website that can be reached via example.ton, compatible with TON DNS domain lookup. Like hosting an NGINX web server on an AWS instance.

TON WWW: A protocol that allows users to access TON Sites, using .ton domains, in a browser.

TON Storage: Decentralized file storage and sharing using torrent-like technology over TON Network.

TON DHT: A distributed hash table - decentralized data structure that stores key-value pairs, where each node in the network manages a portion of the overall data, enabling efficient and resilient data lookup and retrieval. Used as a 'torrent tracker' for TON Storage, an 'input tunnel locator' for TON proxy, and a service locator for TON services.

TON Services: A platform for services available via Network and Proxy enabling browser-like or smartphone application interaction. Think apps - can be on-chain, off-chain, or mixed, and used by human users (traditional apps, e.g. games) or other applications/robots (oracles, file storage). This includes a registry of services and which nodes run them.

TON Payments: A micropayment channel network for fast off-chain value transfers, similar to the Bitcoin lightning network.

Below is a simplified summary of how they fit together from a user perspective.

In summary, in addition to its blockchain core, The Open Network features a comprehensive suite of technologies, including a TOR-like networking stack, decentralized and censorship-resistant DNS, decentralized storage, a proxy for anonymous communication, integrated payments, and more. As TON evolves, it may pioneer a fully decentralized web ecosystem, with websites that are censorship-proof from their HTML code through to their hosting and delivery infrastructure, including servers and proxies. What’s more, with TON Services, TON Payments and Telegram Mini Apps, we expect to see exciting and novel consumer apps and business models, only possible on TON.

Technical Architecture of The Open Network

The technical architecture of The Open Network utilizes a multi-blockchain framework designed to enhance scalability, ensure robust security, and facilitate seamless interoperability. This multi-layered structure allows TON to manage a high volume of transactions and interactions efficiently.

Multi-Blockchain Design

TON's architecture is built around a central Masterchain and multiple Workchains, each of which can be further subdivided into Shardchains. This hierarchical structure is what makes TON able to scale and manage diverse transaction types and volumes across its network.

Masterchain: At the top of the hierarchy is the Masterchain, which plays a critical role in maintaining the overall integrity and continuity of the TON network. It acts as the main ledger that records and validates major network changes, coordinates the various Workchains, and ensures global consensus is maintained. The Masterchain is responsible for critical functions such as finality and checkpointing of transactions across Workchains and Shardchains, serving as the ultimate arbitrator in the network’s multi-chain architecture.

Workchains: These are independent blockchains that run in parallel under the oversight of the Masterchain. Each Workchain is designed to cater to specific needs or sectors—such as different token economies, decentralized applications (dApps), or compliance requirements—allowing for customization and flexibility within the network. Workchains can have their own rules for transaction formats, consensus protocols, and even the virtual machines they operate, which allows developers to tailor functionalities to specific use cases.

Shardchains: To further enhance scalability, each Workchain can be divided into multiple Shardchains. This division is designed to distribute the transaction load more effectively by assigning a fraction of the overall transactions to each Shardchain. By processing transactions in parallel across multiple Shardchains, TON dramatically increases its transaction handling capacity. Shardchains operate under the rules set by their respective Workchain but are primarily focused on scaling transaction throughput. They synchronize and validate transactions with the help of the Masterchain, which aggregates and finalizes transactions across the entire network.

This multi-blockchain approach allows TON to handle diverse and high-volume transactions efficiently by delegating tasks across its different chains according to their specialization. This division not only optimizes processing speeds and network response times but also enhances the network's ability to scale dynamically based on load and demand.

Scalability Through Shardchains

Scalability is a critical aspect of TON's architecture, primarily achieved through its Shardchains. Each Shardchain processes only a subset of transactions, which effectively spreads the computational and storage workload across the network. This method reduces latency and increases throughput, as multiple Shardchains operate simultaneously without overloading any single chain.

The dynamic configuration of Shardchains also allows TON to adjust its scalability based on real-time usage and transaction volume. If a particular Workchain becomes heavily loaded, it can be further subdivided into more Shardchains, thereby distributing the load more evenly and maintaining high performance across the network.

Cross-Chain Interoperability: Facilitating Communication Between Chains

Interoperability within TON is crucial for maintaining fluid communication between its various blockchain components. The Masterchain facilitates this by managing cross-chain transactions and data transfers, ensuring that operations across Workchains and Shardchains remain consistent and secure. This system allows for seamless interaction between different parts of the network, enabling complex operations that involve multiple chains to execute smoothly without user intervention.

Security: Proof of Stake and Nominator Pools

Security in TON is upheld by a Proof of Stake (PoS) mechanism, where validators stake tokens to secure the network. This PoS system is enhanced by the introduction of nominator pools, which allow smaller stakeholders to collectively participate in the validation process, thus democratizing the security process and enhancing the robustness of the network. Validators are incentivized to act honestly due to the economic stakes involved, and the nominator pools ensure that the opportunity to participate in network security is accessible to a wider range of stakeholders.

The multi-blockchain architecture of TON, with its division into Masterchain, Workchains, and Shardchains, is a powerful model for achieving the scalability, flexibility, and security required by modern blockchain networks. This design enables TON to efficiently handle a growing ecosystem of decentralized applications and services while maintaining high throughput and robust security.

Economic and Governance Model

TON has experienced significant changes since a $1.7 billion ICO in 2019 faced regulatory hurdles. Revived in 2022 by the TON Foundation, it has grown into a decentralized network with a supply of 5 billion coins, expanding by 0.6% annually (30 million tokens). Currently, 2.5 billion coins circulate, supporting transactions, staking, and governance within its ecosystem.

The initial distribution saw 98.55% of tokens mined through proof of work (PoW), with the remaining 1.45% held by the development team.

To address centralization risks, a significant proposal was passed in February 2023 to freeze inactive wallets for four years, impacting 21% of total tokens. This decision targeted 171 wallets holding over 1.081 billion TON coins, equating to approximately 21% of the total circulating supply. The move aimed to enhance liquidity and sparked discussions around centralization and governance autonomy within the TON ecosystem, underscoring the delicate balance between regulatory actions and decentralized principles.

Validators in the TON network play a crucial role in maintaining its integrity, earning up to 10% of their stake annually if they diligently perform their duties, such as signing all blocks, remaining online, and avoiding invalid block signatures. This reward system compensates validators sufficiently, allowing them to invest in better hardware to manage the growing volume of transactions. On average, no more than 10% of the total TON coin supply is expected to be locked in validator stakes at any time, producing an inflation rate of about 2% per year. This inflation acts as a payment from the community to validators for their service in maintaining the network's operation.

Conversely, if a validator acts maliciously, a portion or all of their stake can be confiscated as a penalty. A significant part of this confiscated stake may be burned, creating a deflationary effect on the total supply of TON coins. A smaller portion of the fine could also be awarded to the validator or "fisherman" who provides proof of the guilty validator's misbehavior, further enhancing network integrity by incentivizing the monitoring of validator activities.

The fee mechanism in TON differs significantly from Ethereum’s user-pay model. Instead, TON adopts a developers-pay model. Unlike the synchronous smart contracts on Ethereum, both Dfinity and TON utilize an asynchronous actor architecture to enable parallel computation.

Transaction fees in TON comprise several components: storage fees, message ingress and egress fees, routing fees, and computation fees. On average, the transaction fee is around 0.005 TON, but this value can be adjusted by validators as needed. The purpose of the transaction fee is to deter malicious actors from overloading the network. Additionally, half of the collected fees are used to reward validators and nominators, incentivizing them to maintain the network’s security and efficiency.

Half of the transaction fees in TON are burned, meaning they are sent to a black hole address and permanently removed from the circulating supply. Additionally, the majority of the slashed funds from misbehaving validators are also burned. This burning mechanism helps to reduce the circulating supply, contributing to the overall economic stability and deflationary aspects of the TON network. TON can also be purchased directly through the Telegram Wallet for services like anonymous accounts, advertising and purchasing stars on the Fragment marketplace

Governance Within the TON Community

TON employs a decentralized voting platform, TON.VOTE, where token holders influence the project's development and major policy decisions. This participatory approach ensures that the community remains at the heart of the ecosystem's evolution.

Major Investors and Partnerships

Institutional adoption of TON has been significantly bolstered by major investments from prominent firms such as Pantera Capital and Animoca Brands. Pantera Capital has shown substantial confidence in TON by launching a dedicated investment fund to raise capital to buy TON tokens. This move reflects their bullish outlook on TON's potential within the crypto market. Animoca Brands, known for advancing digital property rights in gaming and the open metaverse, has become the largest validator on the TON blockchain, supporting various GameFi projects and integrating TON-based applications within Telegram. These strategic investments and partnerships underscore a robust institutional endorsement of TON's capabilities and its future potential in the blockchain space.

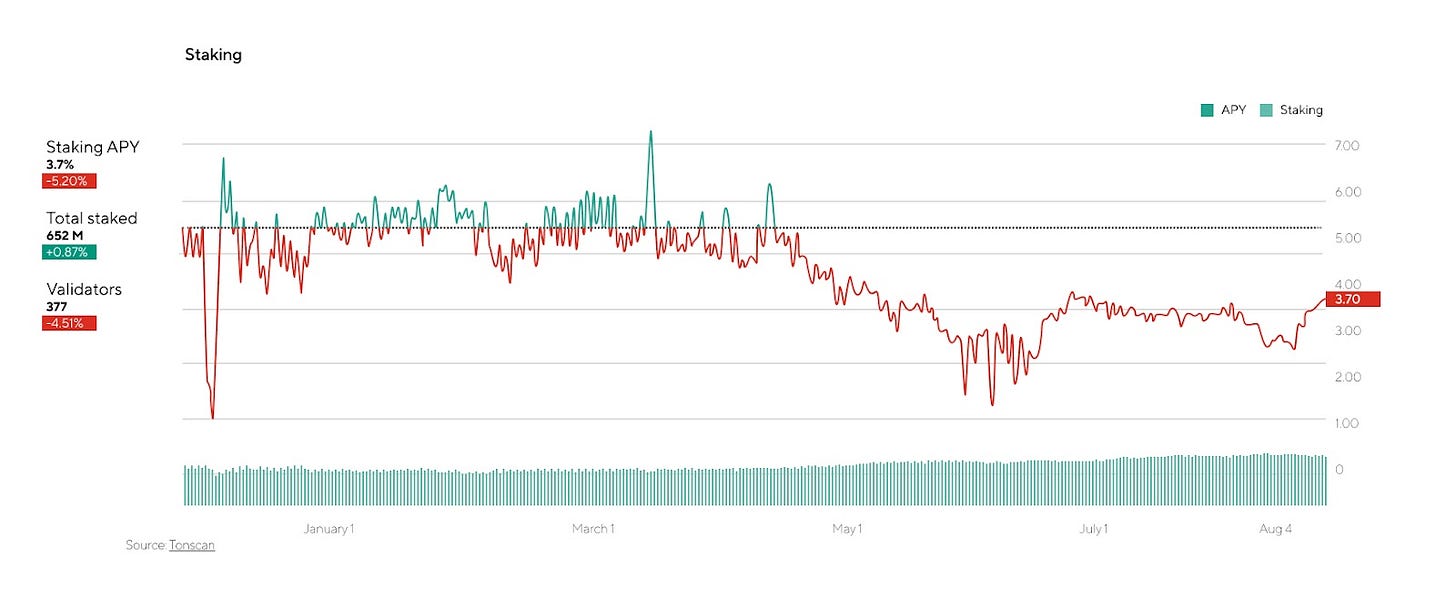

Staking and Its Impact on Decentralization

TON operates on a Proof of Stake (PoS) consensus model, where validators play a crucial role in maintaining network security by ensuring block validity and earning Toncoin as rewards. To participate, validators need advanced hardware and substantial Toncoin staked for a fixed term. The demanding hardware requirements, such as a 16-core CPU and high-speed internet, often limit this role to those with significant resources, potentially centralizing control among wealthier participants. Validators not only earn rewards from transaction fees and new coins generated during validation, with an average daily income of approximately 120 Toncoin, but they also face stringent penalties for non-participation or malicious activities, ranging from fines to complete stake forfeiture. This structured incentive and penalty system aims to ensure robust network health and integrity. Validator positions are competitive, requiring a minimum of 300,000 Toncoin to enter elections, with successful candidates validating blocks for entire validation cycles.

TON’s tokenomics is designed to balance incentives for validators, ensure network security, and maintain economic stability. The combination of a PoS consensus mechanism, a robust staking system, and a transaction fee structure aligned with network usage ensures the sustainability and scalability of the TON blockchain.

Current Status of The Open Network (TON)

The Open Network has shown measurable growth and activity, as indicated by several financial metrics and user engagement statistics. This section of the report provides an overview of TON's current statistics, highlighting key aspects of its ecosystem.

Total Value Locked (TVL): TON reports a TVL of approximately $919 million. Below, we’ll discuss which applications have the most TVL.

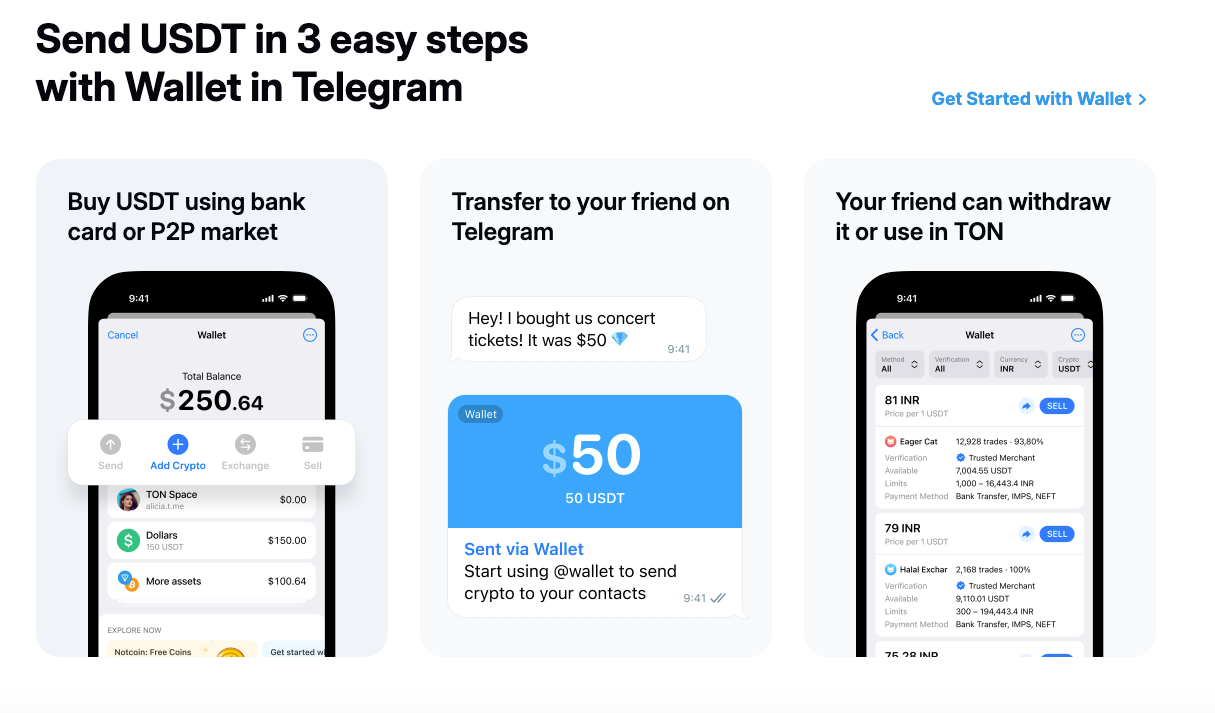

Stablecoins: The market capitalization of stablecoins on TON is $619 million, with USDT being the only stablecoin available. TON accounts for about 0.38% of the total stablecoin market capitalization.

USDT's integration is notable, particularly its utility for transactions via Telegram.

Users can bridge USDT to the TON network using platforms like Symbiosis and Layerswap, facilitating the use of stablecoins within the TON ecosystem.

TON Token Metrics:

Current Price: $6.48

Market Cap: $16.3 billion

Fully Diluted Valuation (FDV): $33 billion

User Adoption

The network's user engagement is indicated by:

Onchain Activated Wallets: More than 12 million wallets have been activated onchain, a significant increase from ~1 million in January.

Active Monthly Wallets: There are 4.2 million active monthly wallets, up from ~300,000 in January.

TON DEX Landscape: DeDust & STON.fi Spotlight

The decentralized exchange (DEX) landscape on the TON blockchain is defined by its innovation and user engagement, with seven operational DEXes contributing significantly to the ecosystem. In 2024, on-chain data indicates a notable upward trend in transactions and daily active users, driven by the Open League initiative and the native integration of USDT. Among these platforms, DeDust and STON.fi stand out due to their substantial trading volume and TVL.

Both DeDust and STON.fi are instrumental in the recent surge in TVL on TON, which has been amplified by The Open League's boosted liquidity pools initiative. This program provides TON incentives for users engaging in DeFi activities, which has propelled significant increases in TVL, particularly noticeable during the program’s initial four seasons. For Season Five, participants can explore enhanced pool options on both DeDust and STON.fi.

STON.fi:

STON.fi is the dapp with the highest TVL in TON. It is renowned for its integration with TON wallets, simplifying the process for users to swap tokens directly within the ecosystem, and it also allows users to become liquidity providers, with additional benefits for engaging in staking and farming. Key statistics include:

TVL: Holds a TVL of $277 million.

Strategic Developments: Plans are underway for STON.fi to evolve into a cross-chain DEX, which would introduce features such as order books and margin trading, significantly broadening its market appeal and functionality.

DeDust

DeDust operates as an Automated Market Maker (AMM) on TON and boasts the second-highest TVL across the network. It integrates various asset types seamlessly, including native coins and tokens from other blockchains. As of the latest data:

TVL: $258 million in TVL.

Staking and SCALE Token: It offers a staking program that converts swap fees into SCALE tokens, used to reward users. This not only fosters liquidity but also stabilizes the ecosystem.

Transaction Efficiency: DeDust is optimized for low gas usage, facilitating cost-effective transactions. It supports stablecoin swaps and complex trade types like multi-hop transactions.

Interoperability Features: Features an early-stage bridge to Ethereum, enhancing its capability to manage wrapped assets like WBTC and stablecoins, facilitating asset movement across blockchain networks.

Comparison: DeDust vs. STON.fi

Swap.coffee: A New DEX Aggregator on TON

TON blockchain has recently welcomed a new player in its DeFi ecosystem, Swap.coffee, a DEX aggregator designed to enhance user experience in trading by offering optimal exchange routes. The platform stands out with its user-friendly interface that simplifies the trading process for users of all levels by automating the selection of DEXs and managing liquidity concerns.

For seasoned traders, Swap.coffee offers advanced settings that allow for the customization of trading strategies, providing opportunities to achieve significant savings on larger transactions, albeit with higher risk. This feature caters specifically to experienced users looking for more control and better profit margins in their trading activities.

Liquid Staking on TON with Tonstakers

Tonstakers is the third largest project by TVL, managing $212 million.

Tonstakers introduces a dynamic approach to liquid staking within the TON blockchain, offering users the ability to earn yields securely, equally, and transparently. This service is tailored for users who wish to contribute to blockchain security while gaining rewards, without having to sacrifice access to their staked assets.

Secure and Open Liquid Staking

Tonstakers operates in collaboration with TON Core Developers, ensuring the platform is robust and well-integrated within the TON ecosystem. It champions transparency and security with its open-source protocol, available for review and contribution on GitHub. Furthermore, the platform's security measures are verified through an audit by Certik, a leading blockchain security firm, ensuring that it is secure to the core.

Non-Custodial Staking

What sets Tonstakers apart is its non-custodial approach to staking. Users maintain complete control over their assets without any intermediaries, meaning that while their TON coins are staked, they're not held or controlled by Tonstakers but remain under the users’ control.

Telegram Ads: Leveraging TON for Effective Marketing

One of the distinct advantages of TON, in collaboration with Telegram, is its ability to attract Web2 talent pools. This attraction is largely due to the availability of familiar marketing and channel acquisition tools that are integrated into the Telegram platform.

Telegram Ads enable projects to purchase advertisements displayed at the bottom of Telegram channels. This feature has proven to be a highly effective component of the go-to-market strategies for numerous Web3 startups operating within Telegram. These ads not only help in broadening the reach and visibility of projects but also facilitate direct engagement with a targeted user base.

A key aspect of Telegram Ads is their payment structure. Ads are purchased using TON, and remarkably, 50% of the revenue generated from hosting these ads is distributed back to the channel owners in TON. This revenue-sharing model incentivizes channel owners to actively participate in the ad network, enhancing the ecosystem's overall growth and engagement.

Ads can be bought via https://ads.telegram.org/ or https://fragment.com/ads.

TON Growing Adoption in Asia

Leveraging Telegram Mini Apps for Engagement and Transactions

Hamster Kombat is a Tap-to-Earn game where players assume the role of a cryptocurrency exchange CEO. By tapping on hamsters on the screen, players accumulate game points and can earn rewards through various methods. The game combines simple tap mechanics with a passive income mining feature and a card system, enhancing its depth and entertainment value. According to the official Twitter account, as of June 24, there are already 200 million Hamsters!

In Tehran, the capital of Iran, taxi drivers, cyclists, and pedestrians alike are seen fervently tapping on their phone screens during red lights in the hot June weather. Their target is an app named "Hamster Kombat," which they believe has the potential to make them wealthy.

The craze for Hamster Kombat in Iran is comparable to the past success of Axie Infinity in Southeast Asia. During a period of high unemployment in the Philippines, Axie Infinity players were earning an average monthly income of over $300 by playing the game.

Hamster Kombat is more than just a game; it is evident that it is driving the mass adoption of Web3 and fostering community building.

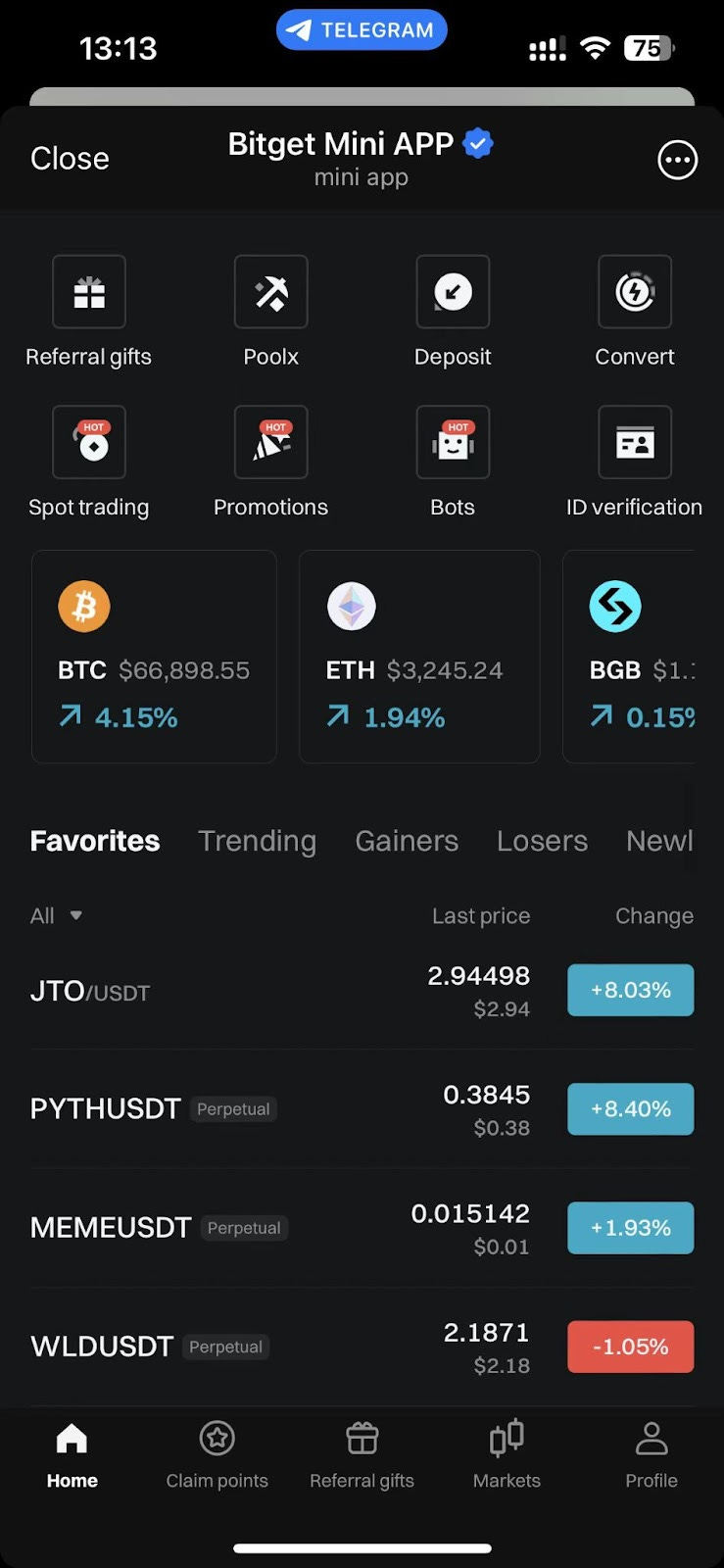

Integration with Bitget for Enhanced Trading Convenience

Bitget has been quick to integrate with the Telegram mini apps, offering functionalities such as spot trading directly within Telegram. The integration allows users to trade cryptocurrencies effortlessly without the need to switch between different applications. The convenience of sharing and trading cryptocurrencies within a social context could significantly enhance user adoption and market penetration in regions where mobile-first strategies dominate.

Game Development and GameFi on TON

Asian game studios dominate mobile games and will be a huge force in gaming on TON.

What's more, Hong Kong-based Animoca Brands, a key player in the GameFi sector, has become the largest validator on the TON blockchain. This status highlights the growing importance of TON in supporting third-party games and GameFi projects. The TON Play platform provides developers with tools to port existing online games directly to Telegram, tapping into its vast user base and facilitating new forms of engagement through decentralized gaming.

Web3 Development Initiatives

In collaboration with Tencent Cloud and Chainbase, the TON Foundation aims to streamline the development process and enhance the deployment capabilities of developers, further fostering the adoption of Web3 technologies. By providing essential tools and resources, this initiative targets to make it easier for developers to create and launch applications on the TON blockchain.

Recognition and Adoption in the UAE

The United Arab Emirates (UAE), and specifically the Dubai International Finance Centre (DIFC), has officially recognized the TON blockchain alongside major cryptocurrencies like Bitcoin and Ethereum. This recognition permits financial institutions in Dubai to utilize Toncoin for transactions, showcasing the growing acceptance and institutional trust in TON within significant financial markets. The official recognition not only enhances TON’s credibility but also opens up numerous possibilities for its use in financial transactions and regulatory frameworks within the region.

India

India, with the second highest number of smartphone users globally, offers significant potential for deeper smartphone penetration. The launch of Reliance Jio in 2016 revolutionized the telecom industry, leading to a substantial increase in data consumption by pricing data significantly lower than the market rate. This caused data consumption in India to jump from an average of 400 MB per user per month to 11 GB. Currently, while the global average price for 1GB of data is $5.09, in India, it is just $0.09.

This creates an ideal environment for Telegram and its ecosystem. With over 100 million downloads, Telegram is one of the most popular messaging apps in India. Integrating these users into the TON ecosystem presents a unique opportunity to monetize this large audience.

As Web3 becomes increasingly mainstream, more apps will prioritize mobile-first UI/UX designs to cater to the vast market of smartphone users similar to the Mini app model adopted by Telegram. India will be a key region for the development and user growth of consumer apps in the future.

Future Outlook

TON is strategically positioned to unlock numerous opportunities for the Telegram community to monetize, share, and grow their businesses. A standout example is Fragment, a decentralized marketplace on the TON network, where users can trade collectibles such as virtual phone numbers and custom Telegram usernames. To date, Fragment has facilitated over $350 million in sales, demonstrating the platform's potential. A promising development on the horizon is the transformation of Telegram stickers into NFTs, a move that could significantly enhance engagement and revenue. With 730 billion stickers sent, making these available as NFTs on the TON blockchain presents a substantial opportunity.

Telegram is evolving its revenue model by integrating revenue sharing with content creators and channel owners through its Fragment platform, which leverages the TON blockchain. This shift from traditional social media models allows creators to earn directly from ad revenues on their channels, promoting a fairer distribution of financial benefits within the digital ecosystem. This approach not only rewards creators for their content but also strengthens the relationship between the platform and its users. Additionally, the implementation of gasless transfers with built-in on-ramps and off-ramps, including bank transfers and exchanges, enhances accessibility and usability, especially benefiting individuals in developing countries who often lack access to banking services.

Telegram has become the first chat-only app to delve seriously into gaming. Since integrating HTML5 compatibility for Telegram bots in 2016, the development of the TON blockchain has aimed to further reduce friction for both users and developers. Through TON, developers gain access to payment rails, decentralized storage for in-game assets, and smart contracts for secure and automated game mechanics, allowing them to efficiently distribute their content to a community with 900 million monthly active users.

TON sets itself apart from platforms like WeChat and other Western social apps by establishing Telegram as a major gateway for Web2 users transitioning into Web3. With approximately 900 million MAU, Telegram represents one of the largest pools of "Web2.5 users" and serves as a primary distribution channel for major crypto markets. Unlike central exchanges like Coinbase and Binance, Telegram’s social nature makes it more compatible with applications that blend social features with financial incentives, providing a better product-market fit for games and other interactive experiences.

Distribution is key to TON’s recent success and underscores the challenges Web3 game developers face in acquiring players. Growth initiatives, including grants, technical support, and marketing assistance, have expedited the onboarding of teams into the ecosystem. In the short term, many teams are likely to leverage TON’s current mindshare to attract users to their games or protocols. Over time, as developer tools and support become more robust, games that adapt learnings from platforms like WeChat in a Telegram-native approach will be crucial case studies.

Looking ahead, TON's future is bright, with its potential for monetization, stablecoin integration, and a thriving ecosystem of mini apps and games. By leveraging its vast user base, scalable infrastructure, and innovative revenue models, TON is well-positioned to become a leading force in the blockchain space, driving significant advancements in decentralized finance and digital content creation.