The Journey of NFTs Through the Cycles

NFTs have evolved significantly since their inception in 2012. Vish BR, the Strategy and Operations Lead at SGC India, looks back at their short but rich history.

Vish BR, strategy and operations lead

Overview

In contrast to the uncertainty of 2018, when I felt unsure about cryptocurrency's future and questioned my understanding of it, the current cycle is different. This is largely due to the significant progress made in the development of application layers, which has resulted in certain applications becoming essential building blocks.

While decentralized applications (dapps) can still be used effectively on the blockchain, some protocols like Aave, Uniswap, Compound, and Maker have undergone extensive stress testing and have proven to be reliable. However, some of these protocols still face challenges.

This cycle is witnessing the mainstream adoption of technology that was first conceptualized in previous cycles. For example, Zcash used ZK-SNARKs in 2014, and this cycle saw the widespread adoption of non-fungible tokens (NFTs) and the concept of the metaverse. The narrative around NFTs and digital ownership, known as the "proof of ownership" (POP) narrative, gained significant traction in late 2020 with the popularity of NBA Top Shot and Cryptopunks. It reached a new peak in 2021 with the sale of Beeple's artwork for $69 million at Christie's.

Here’s a brief look at the short history of NFTs:

The concept of non-fungible tokens (NFTs) began with Meni Rosenfeld, Vitalik Buterin and Yoni Assia's proposal for colored coins in early 2012, which aimed to add metadata to bitcoins to distinguish them from one another and make them non-fungible.

In 2014, the artwork "Quantum" by digital artist Kevin McCoy was minted on Namecoin, a fork of Bitcoin with a proof-of-work consensus mechanism (which Satoshi Nakamoto himself endorsed), and is widely considered to be the first NFT.

In 2014, Robert Dermody, Adam Krellenstein, and Evan Wagner founded Counterparty, a decentralized, open-source platform built on top of the Bitcoin blockchain. One of the key features of Counterparty was the ability for users to create assets and use decentralized exchanges. Counterparty was used for a wide range of projects, including a trading card game and meme trading.

In 2015, the team behind the game Spells of Genesis was one of the first to use Counterparty to issue in-game assets on the blockchain. They were also among the first to launch an ICO at the time. They funded the development of their game by launching a token called BitCrystals, which was used as the in-game currency.

In 2016, memes were minted on the blockchain, and this is when the Rare Pepe memes mined on Bitcoin first emerged, which eventually moved to Ethereum in 2017.

In 2017, NFTs were minted on the Ethereum blockchain for the first time with projects such as Ether Rock, CryptoKitties, and CryptoPunks.

From 2020 to 2022, the narrative around NFTs was that they act as a representation of culture. This bull cycle had multiple projects that peered into the creative potential of the market. Projects such as NBA topshot appealed to the collectible market, generating a revenue of over $200 million. Projects like BAYC aimed to be the Supreme of web3 and made their own claim to fame. We saw Reddit, Meta, Twitter, Adidas, Puma, Nike and others jump on board the NFT bandwagon to explore new ways to interact with their customers.

Where do we go now?

NFT financialization using ERC 721 and ERC 4907

NFTs have become increasingly popular for their ability to digitally represent cultural assets. They are used in video games to represent in-game assets and on decentralized exchanges like Uniswap v3 to represent liquidity positions. The tech has unlimited applications and we are just getting started. NFTs will play a significant role in the financial world, and the ERC 4907 standard will help bring NFTs into finance, gaming, and other sectors. My colleague Eric Nemeth has written an in-detail thread on the significance of the standard:

Consider ape staking as an example. Your BAYC NFTs act as a key to the Ape tokens staked and rewards can be collected by the owner of the NFT not the original staker. Using this token standard, the owner of an asset can sell the rights to the cash flows generated by the asset to another user without giving up ownership of the asset itself. This opens the doors for creating more structured products bringing NFTs and DeFi even closer together. The standard helps use existing legos and build a new product stack.

xNFT

An xNFT (eXecutable non-fungible Token) is a digital asset built on the Solana blockchain that represents ownership rights over its execution and use. It is similar to a standard NFT, but includes additional features and capabilities, such as the ability to run native web3 applications and protocols inside a single wallet. This means that a xNFT can be used as a platform for operable web3 applications, and does not require the user to log in to an external platform to access or use the asset.

The xNFT accomplishes this through a service called Backpack. Backpack is a platform for managing and accessing xNFTs and dapps on the Solana blockchain. It acts as an operating system for xNFTs, managing private keys and granting holders access to dapps. Backpack can be compared to an app store for smartphones, providing an infrastructure for hosting and accessing xNFTs and any dapps built on the platform. The xNFT standard allows dapps built on Solana to create and run xNFTs natively within the Backpack wallet.

Omnichain NFTs are digital assets that can be used and accessed on multiple blockchain networks. This can be especially useful for projects that want to reach a wider audience or take advantage of different blockchain features. For example, a game that is built on Polygon may want to partner with a project on Ethereum to expand its user base by offering incentives and/or facilitating the use of the project’s NFTs in the game. Alternatively, a project could launch an NFT on Ethereum, which has high liquidity and then move it to other chains for specific use cases, such as using Polygon for gaming or Arbirtum for hedging.

Omnichain NFTs provide flexibility and opportunities for businesses to explore new business models and gamification strategies. It provides the tools to access community, and liquidity across chains to create the best possible outcome for the project. Overall, Omnichain NFTs offer a range of possibilities for projects to explore and utilize in order to drive adoption and increase user engagement.

Fashion NFTs

As more people embrace digital technologies such as emojis, filters, and augmented reality (AR) in their daily lives, a new segment of social media users has emerged who value and prioritize a digital existence with anonymity and pseudonymity as key aspects. Avatar skins help clothing labels monetize their brands, and this extends to influencers as well.

Using NFT technology to provide ownership and enrich engagement with customers through virtual activations can be invaluable to brands. In response, fashion houses like Gucci, Valentino, and other luxury brands are experimenting with NFTs and other virtual technologies to create digital fashion items that can be worn in games or on apps.

For example, Gucci has released digital-only pairs of sneakers in collaboration with Wanna, Valentino is releasing avatar accessories on Animal Crossing, and Balenciaga and Moschino are exploring virtual activations through gaming. In December 2021, a project called RTFKT was acquired by Nike and is now working on making its signature Cryptokicks NFTs available in real life. NFTs can also be a way to be able to combat knockoffs, which make huge sales in many parts of the world.

Loyalty Programs

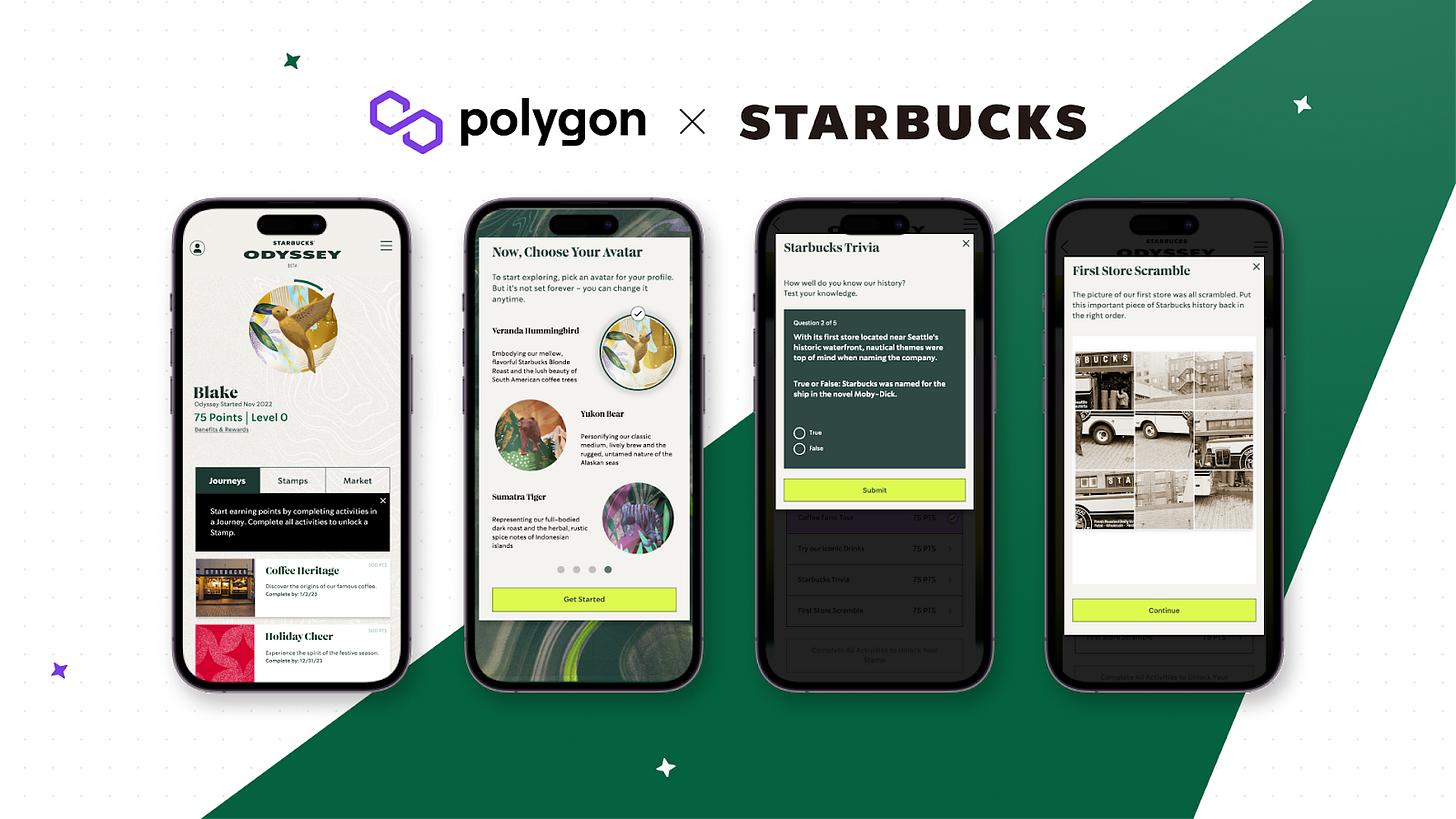

Loyalty programs are a great way for businesses to reward and retain their customers. Integrating NFTs in rewards for customers creates more engaging and personalized experiences with their audiences, ultimately helping businesses to build stronger relationships and drive customer retention. Well-known brands such as Starbucks, Nike, Meta (via Instagram), and Reddit have all embraced NFTs and created tailor-made experiences for their consumers.

Starbucks and its odyssey programme on Polygon is a great example. Their campaign was designed to improve engagement with their customers and make them spend more time with the brand, leading to more mind share and over time revenue. Another example would be Gucci, or any fashion brand, that have provided access to private events using NFT tech.

This also provides an additional layer of privacy and security as the identity of the customer moves away from their name, phone number and other details to a wallet address.

Metaverse

The concept of the metaverse is the unification of the physical and virtual worlds, creating a peer-to-peer environment where people can interact with each other in a lifelike way in digital spaces. Since ownership is going to be key, assets in the metaverse are primarily going to be NFTs or semifungible tokens.

Metaverses can be differentiated based on the underlying tech into:

One where immersion is complete without a reference to reality i.e. VR-based metaverses

Where real-world objects are overlaid with computer generated content

The current version where we are experiencing a 3D world in a 2D outlay

This isn't an exhaustive list as there may be new hybrids which form over time. NFTs are the base tech that will represent assets in the metaverse. It can be as land parcels of highly lucrative metaverses, token gating in the metaverse, filters to be used on social media, NFT for premium subscription services etc.

IP/Patents

NFTs can be used to represent and safeguard intellectual property (IP) rights and patents. They also offer a distinct advantage over traditional IP tools such as trademarks and copyrights because they allow users to prove ownership of a specific piece of content or IP. This is impossible with traditional methods, which often rely on complex legal systems to establish ownership. They can also create an immutable record of the history of a particular piece of IP by being stored on a blockchain, a decentralized and secure database resistant to tampering. By displaying an NFT and its corresponding transaction history on the blockchain, its owner can prove that they are the original creator of a work at any point in time. These assets can also protect patents by providing data for verification and creating a public ledger that documents all patents-related transactions, making it easier to establish ownership and prevent fraud or counterfeiting. In summary, the assets provide a secure and effective way to protect and manage IP rights and patents in the digital world.

Music Industry

NFTs have the potential to revolutionize the music industry by providing proof of ownership for digital assets, eliminating intermediaries and enabling musicians to have more control over their work. NFTs can provide immutable records of ownership for songs, music videos, and other music-related assets. This allows musicians to deal directly with their fans, rather than relying on intermediaries to produce or distribute their music. Additionally, NFTs can enable musicians to receive royalties automatically on every sale of their NFTs. Overall, NFTs have the potential to make the music industry more equitable, by giving creators more control over their work and helping to reduce copyright infringement.

Conclusion

NFTs offer a unique set of advantages for investors and holders. They are secure, easily transferable and flexible, making them ideal for proving ownership of various assets. NFTs have the potential to change many industries, and they are becoming increasingly popular. They can be used for various purposes like virtual assets, gaming, digital art and more, and have the potential to disrupt industries such as sports and fashion. Additionally, it is expected that in the future, more blockchain platforms will integrate NFT functionality which will bring about new novel use cases. The ability to distinguish two objects on chain is truly powerful as a technology. I believe we are still early in the adoption and wider utilization of NFTs.