State of the Stablecoin Market and the Potential Impact in Emerging Markets

How stablecoins can help emerging countries.

Executive Summary

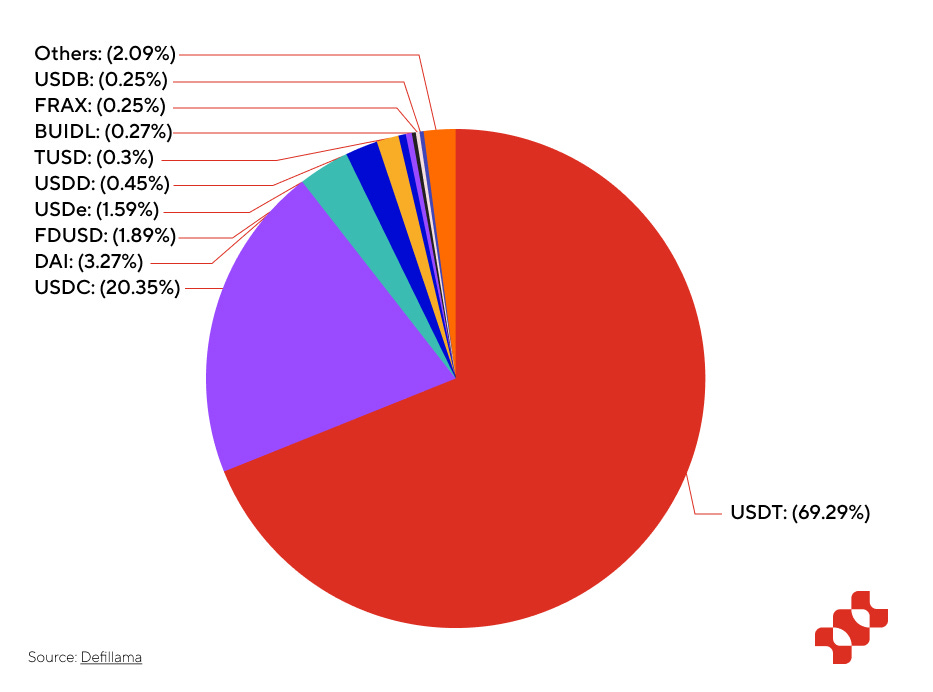

The global stablecoin market is witnessing a remarkable expansion, with a current market capitalization of approximately $160 billion. This report delves into the dynamics of the top five stablecoins by market cap, including Tether (USDT), which dominates the market with a 69% share.

The report highlights the significant adoption of stablecoins in emerging markets, where they are increasingly viewed as viable solutions to economic volatility, offering stability, lower transaction costs, and financial inclusion. The potential impact of stablecoins in these regions is profound, providing a reliable alternative to unstable local currencies and facilitating greater participation in the global digital economy. The report also addresses the regulatory landscape, which is evolving as various nations and global organizations seek to establish frameworks that balance innovation with financial safety.

Introduction: Current State of the Stablecoin Market

The total market capitalization of stablecoins currently stands at approximately $160 billion, up from $130 billion a year ago. Tether (USDT) remains the most significant one, with a market dominance of 69.29%.

Here is a detailed look at the top five stablecoins by market capitalization:

Tether (USDT): With a market cap of $111 billion, USDT is the stablecoin with the highest usage across exchanges. 50% of the USDT in circulation is on the Tron blockchain, 40% is on Ethereum, and the remaining 10% sits across several other networks.

USD Coin (USDC): As the second-largest stablecoin, USDC holds a market cap of $32.7 billion. It has experienced a growth of 50% over the past 5 months, being one of the largest beneficiaries of this current bull market.

Dai (DAI): Dai has a market cap of $5.25 billion. It observed an increase of 2.97% in the last month, following some controversial decisions such as including Ethena’s USDe as collateral.

First Digital USD (FDUSD): FDUSD has shown remarkable growth since its launch, reaching a market cap of $3 billion.

Ethena’s USDe (USDe): USDe, the hottest new ‘digital dollar’ launched only in February this year, has quickly reached a market cap of $2.5 billion. After an incredible initial adoption, USDe has more recently slowed down its growth.

Notably, over 85% of the stablecoins live on Ethereum and Tron.

Besides Tron, Solana is the only blockchain in the top 10 networks by stablecoins market capitalization that’s not an EVM-blockchain. It amasses $3.6 billion in stablecoins, with USDC being the clear dominant with 74.79% of the share.

Usage of Stablecoins:

Adoption: There are now 93.5 million crypto addresses that hold stablecoins, showcasing rapid adoption, especially for remittances and daily transactions. Tether, as the largest stablecoin by user base, represents a significant portion of this market with over 76 million holders.

Transactional Volume and Active Addresses: Stablecoins like USDC and BUSD are also widely used, with TRON and BSC hosting most transactions despite a lower dollar volume compared to platforms like Ethereum, indicating a strong retail presence.

Why stablecoins are needed in emerging markets

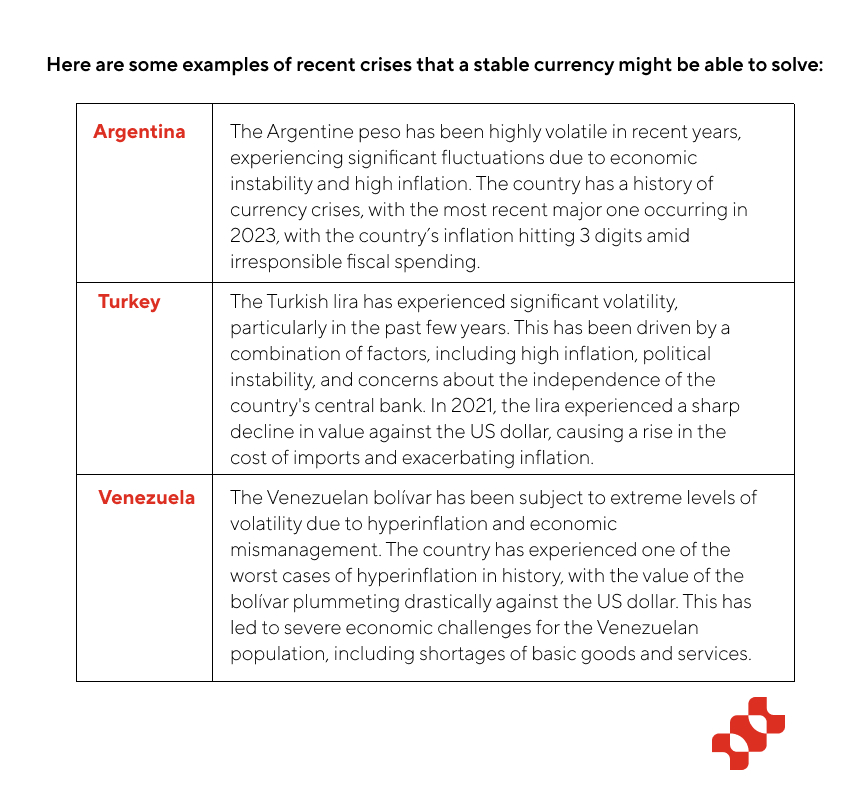

Emerging markets are characterized by volatility and economic transitions, presenting unique challenges that stablecoins could potentially mitigate.

Given the growing adoption, with nearly 100 million holding addresses, stablecoins offer a promising alternative to traditional financial systems.

Stablecoins used for remittances can significantly benefit developing countries by addressing the high transaction costs and inefficiencies associated with traditional money transfer methods.

Remittances are a crucial source of income for many developing nations, helping to reduce poverty, finance education, healthcare, and support small businesses. Traditional remittance channels often incur high fees, averaging around 6.25%, which can be a burden for low-income families.

By leveraging digital platforms and financial technologies, stablecoins can reduce these costs, enhance the speed and security of transactions, and increase accessibility for unbanked populations. This shift towards digital remittances can also promote financial inclusion, stimulate local economic development, and ensure that a larger portion of the remitted funds is available for the recipients, thus maximizing the positive impact on their livelihoods and economic stability.

Adoption

According to Chainalysis, which measures the adoption of crypto all over the world, countries like India, Nigeria, Vietnam, and the Philippines are among the top performers, showcasing a widespread acceptance and utilization of cryptocurrencies among everyday citizens. It’s no surprise that emerging countries are the ones that are most entrenched in the blockchain ecosystem, since they are the ones that need it the most: a permissionless system that allows them to make payments, take on loans, earn yield, and much more, with only their phones. Even though there have been numerous attempts to “unbank the unbanked” with Web2-type fintechs, crypto is still gaining ground.

In Latin America, for example, Argentina stands out as a great example of how stablecoins are penetrating deep into the society’s manner of escaping from rampant inflation. From October 2022 through October 2023, almost 80% of people who bought any cryptocurrencies via exchanges in Argentina bought USDT, not BTC or ETH. Similarly, over the same period, Braze’s share of USDT was closer to 50%, still quite high.

Looking at a different region, in Africa the predominant transaction tokens are stablecoins. Between 2022 and 2023, 40% of the crypto exchanged in Sub-Sahara Africa came from stablecoins.

Regulatory Environment

The state of stablecoin regulation in emerging markets is in a phase of ongoing development and adaptation, as regulatory bodies and governments seek to balance the benefits of financial inclusion and innovation with the potential risks associated with digital currencies.

In the past year, there has been significant movement towards establishing regulatory frameworks for stablecoins in various regions. For instance, the Monetary Authority of Singapore (MAS) announced a new framework that will regulate stablecoin-related activities, focusing on reserve assets, redemption, disclosures, and prudential and solvency requirements for issuers of MAS-regulated stablecoins. Similarly, the Republic of Kazakhstan's Financial Services Authority (AFSA) announced the implementation of a regulatory base for stablecoins effective from January 1, 2024, demonstrating a proactive approach to addressing this emerging area of digital finance.

On a global scale, there is a push for consistent and effective regulation, supervision, and oversight of stablecoin arrangements to address potential financial stability risks, with a focus on promoting responsible innovation and providing sufficient flexibility for jurisdictions to implement domestic approaches. However, disagreements between the G7 and G20 on the specifics of stablecoin regulation suggest that the process of establishing universal norms and standards may face challenges.

The International Monetary Fund (IMF) and the Financial Stability Board (FSB) have been identified as key players in shaping global standards for stablecoins, with a focus on the potential impact of stablecoin use on wider financial stability and the macro-financial implications.

In the U.S., the Lummis-Gillibrand Payment Stablecoin Act was introduced on April 17. It aims to create a regulatory framework for payment stablecoins. Key aspects of the bill include:

One-to-One Reserves: It mandates that stablecoin issuers maintain one-to-one reserves, ensuring all stablecoins are fully backed by cash or cash equivalents.

Prohibition of Unbacked Stablecoins: The bill bans unbacked, algorithmic stablecoins, further tightening the regulatory environment for these digital assets. This measure aims to prevent scenarios like the collapse of TerraUSD, which had significant repercussions on the crypto market.

Protection of the U.S. Dollar's Dominance: The legislation seeks to maintain the U.S. dollar's dominance in the global digital economy by setting standards for U.S.-issued stablecoins.

Dual Banking System Preservation: It preserves the existing authority of state regulators over non-depository trust companies and allows state trust companies and federal or state depository institutions to issue stablecoins.

However, critics say that the bill could stifle innovation in the digital asset space and breach First Amendment rights by imposing strict regulations on stablecoin issuers. They argue that the bill's approach could hamper the growth and development of the digital asset industry in the United States. Moreover, the bill has been criticized for preempting state authorities over trust companies and money transmitters, and for handing the Federal Reserve unprecedented authority over firms that don't create new money.

Conclusion

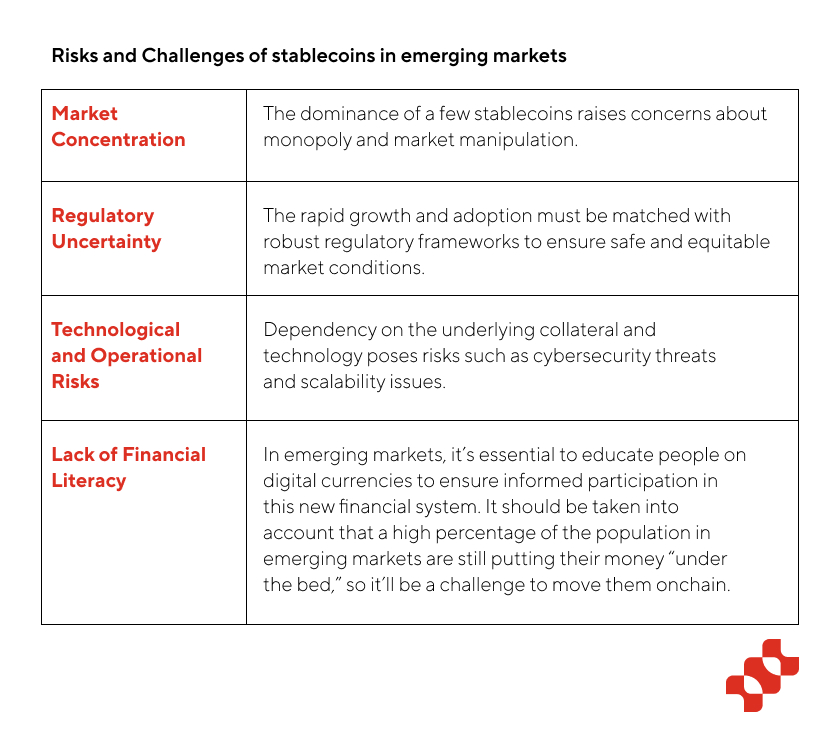

Stablecoins stand at the forefront of financial innovation in emerging markets, offering a transformative potential that is both expansive and inclusive. As detailed in this report, stablecoins like USDT, USDC, and newer entrants like USDe are becoming integral to economic activities in these regions, driven by their ability to mitigate traditional financial system flaws such as high inflation and inefficient banking services.

However, the rapid growth of stablecoins comes with challenges, including regulatory adjustments and the need for enhanced financial literacy. To maximize their positive impact, policymakers, industry leaders, and financial institutions must collaborate on developing robust regulatory frameworks that ensure stability and build trust while fostering innovation and growth. By addressing these challenges, stablecoins could significantly contribute to economic resilience and financial inclusivity, empowering businesses and individuals alike to thrive in an increasingly interconnected and digital global economy.