Ryze Roundup: Fed’s Dovish Turn, Sony’s Web3 Strategy & Stablecoin Adoption

Second edition of the Ryze Roundup.

Market Commentary

Last Friday, Fed Chair Jerome Powell delivered a notably dovish speech at Jackson Hole, stating that "the time has come for policy to adjust." This marks a significant shift in the Fed's focus from combating inflation to addressing the risk of rising unemployment. Consequently, the market is now expecting the Fed to be proactive, pricing in over 100 basis points of rate cuts across the next three meetings, with an additional 100 basis points anticipated for 2025.

However, this optimism quickly faded as markets sold off sharply by Tuesday. Several factors contributed to this decline. Firstly, regulatory concerns are mounting: OpenSea received a Wells notice from the SEC, which categorized NFTs on the platform as securities. In response, OpenSea has committed $5 million to support NFT creators and developers with legal defense against potential SEC actions. Secondly, Telegram CEO Pavel Durov was arrested last Saturday in France as part of a cybercrime investigation involving allegations of providing unauthorized cryptography services and tools. Additionally, the TON network experienced two outages this week after the DOGS memecoin airdrop overloaded the network, leading to a loss of consensus among validators. Lastly, our ongoing concerns about another wave of unwinding from the yen carry trade were validated as the yen strengthened further following Powell's dovish remarks.

“After macroeconomic factors, regulatory concerns continue to top the list of factors influencing and in most cases weighing on crypto prices, as we saw this week with regulatory action in both the U.S. and France.” – Matthew Graham, managing partner.

In corporate news, NVDA’s highly-anticipated earnings slightly exceeded expectations, and the company announced a $50 billion stock buyback. Despite this, NVDA shares fell 8% after-hours. Reports of complications in manufacturing their new Blackwell processor lineup have raised concerns about potential delays. The decline was further fueled by a heavily skewed long retail positioning that eventually had to unwind.

With Powell and the Fed signaling the start of a rate-cutting cycle, we anticipate increased global liquidity will eventually lift risk assets. There are early signs of this: the People's Bank of China (PBoC) injected a substantial RMB 1,042 billion (US$150 billion) into Chinese money markets this week, boosting liquidity in global manufacturing, industrial sectors, and commodity markets. Additionally, U.S. Treasury Secretary Janet Yellen has $740 billion remaining in the Treasury General Account that could be deployed. We look to today’s PCE inflation figures for further insight into the Fed’s next steps.

Key News and Events

Next Steps in Stablecoin Adoption

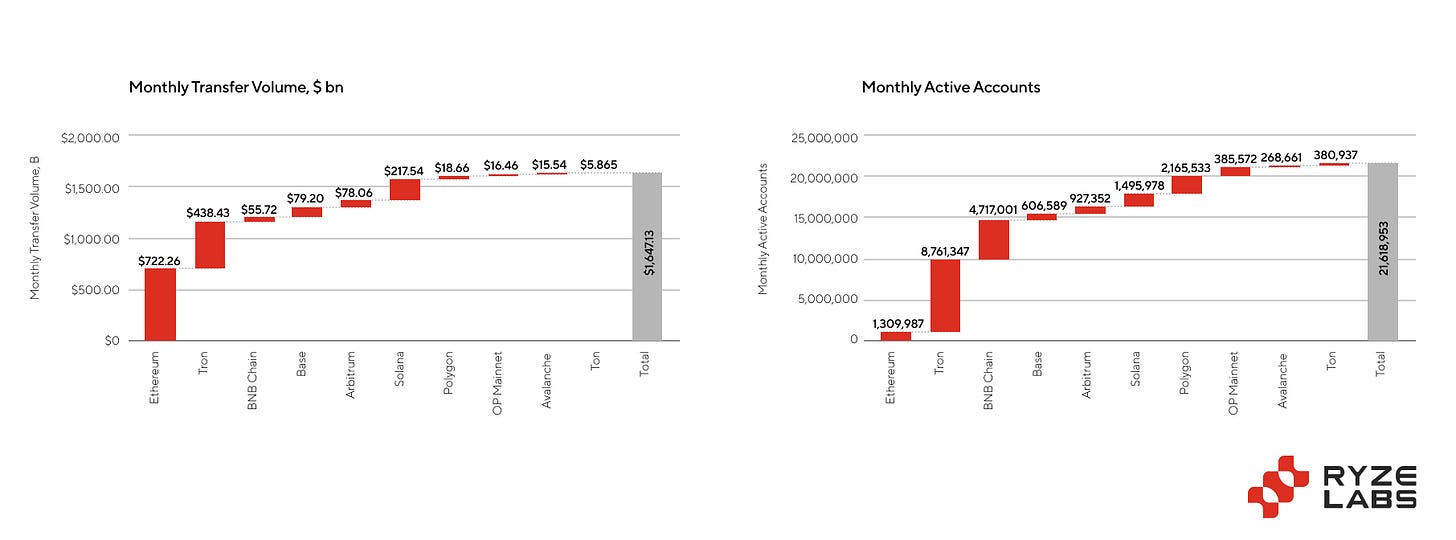

When discussing successful use cases in the crypto space, stablecoins are often the starting point. According to Artemis, the total value of stablecoins transferred on the ten largest chains last month reached approximately $1.648 trillion. If annualized, this volume would surpass Visa’s annual total of $15.5 trillion. While this sounds promising, there are a few important considerations. Firstly, Visa's volume includes both payments and transactions, whereas with stablecoins, the purpose of transfers—whether paying for a service, moving funds between wallets, or making investments—is not easily distinguishable. This lack of clarity makes direct comparisons challenging, but the overall trend for stablecoin volume remains positive with growth on an annual basis.

A more critical factor in considering mass adoption is the number of monthly active addresses involved in stablecoin transfers on these ten chains, which stands at 22.5 million. This figure is lower than the number of monthly credit card users in any developed country. Additionally, it’s important to note that these 22.5 million addresses do not necessarily represent unique users, as they may include the same individuals using different chains, institutions, protocols, or even AI agents conducting transactions. For instance, as of June 2024, the TRON network has over 239 million total accounts, yet only 8.76 million conducted stablecoin transactions in the past month.

Therefore, expanding distribution and payment infrastructure remains a priority for the industry. This is evident from several recent partnerships:

Solana Pay, which offers low-cost, fast USDC transactions, is now integrated as a Shopify app, reaching millions of businesses.

Solana has partnered with PayPal to expand the use of the PYUSD stablecoin. PayPal seeks a strong Web3 partner, while Solana aims to tap into PayPal’s user base of 429 million monthly active users (MAU) as of 2024.

Visa has launched a stablecoin pilot on the Solana blockchain.

TON has partnered with Tether to onboard Telegram’s 900 million MAU.

“When comparing transaction volumes, it's important to remember that crypto volumes include both economic activity and price discovery. Therefore, it makes more sense to compare crypto transaction volumes to a combination of platforms like Visa and global stock and commodity markets. Comparing crypto volumes to just Visa alone would be misleading.” – Matthew Graham.

Is $ASTR the Next $TON? Leveraging Sony’s Millions-User Ecosystem with Astar Network

Sony made a major move into the Web3 arena with the launch of its new division, Sony Block Solutions Labs (Sony SBL) last Friday. The division is spearheading the development of Soneium, an Ethereum Layer 2 network, in collaboration with Startale Labs, the team behind Astar Network. This marks a significant step forward for both Sony and Astar in the blockchain space.

Soneium is being built on Optimism's OP Stack and supports Ethereum Virtual Machine (EVM) smart contracts, positioning it as a strong contender in the Layer 2 ecosystem. The network is currently gearing up for its testnet launch, with technical documentation and software development kits expected to be released soon.

The partnership between Sony and Astar combines Sony's expansive entertainment ecosystem and vast consumer reach with Astar's blockchain expertise. Soneium will closely integrate with the Astar zkEVM network and use Astar's ASTR token as a core asset within its ecosystem. This news has already positively impacted the market, with the price of ASTR rising 6% shortly after the announcement.

Sony SBL is focused on exploring innovative mechanisms for profit-sharing between creators and fans, safeguarding creator-generated content, and fostering interoperability across digital and real-world environments—all key trends in the Web3 landscape. Leveraging Sony's extensive distribution network and penetration into mainstream consumer markets could greatly accelerate Web3 adoption.

For investors, it's important to consider the parallels between Sony's venture and Telegram's success with its TON blockchain. The investment thesis for TON was largely based on Telegram's massive user base and high engagement rates. Sony, with its wide array of products and services, may have a Monthly Active User (MAU) base that even surpasses Telegram's. This user base spans multiple sectors—gaming (PlayStation Network), music streaming, film, and consumer electronics—offering significant potential for Soneium's adoption.

The same thesis that attracted interest in TON could apply even more strongly to Soneium. Sony's established footprint in the entertainment and technology sectors provides a ready-made ecosystem for blockchain integration, potentially driving faster and more widespread adoption than what Telegram achieved with TON. This extensive user base and diverse consumer touchpoints could serve as a key differentiator for Soneium in the competitive Layer 2 market.

“We’ve seen prestigious companies enter during previous market cycles as well. What’s most important is if they will stick around. With digital native companies like Telegram that share crypto principles, that’s less of a concern. With Sony time will tell.” – Matthew Graham.

The project has also secured partnerships with leading Web3 companies, including Circle, Chainlink, Alchemy, and The Graph, which will provide essential infrastructure and services. These partnerships bolster Soneium's position and potential for success in the blockchain space.

As the project progresses, key metrics to watch will include the successful launch and adoption of the Soneium testnet, the growth of its developer ecosystem, and any announcements regarding integration with Sony's existing products and services. The performance of the ASTR token may also serve as an indicator of market sentiment towards this collaboration.

TON Blockchain Faces Network Outages Amid DOGS Token Launch

The Open Network (TON) faced significant disruptions this week, primarily due to network congestion triggered by the highly anticipated DOGS token launch. The Telegram-based memecoin airdrop drew millions of users, resulting in multiple outages and underscoring TON’s need for better scalability.

The DOGS token airdrop launched at 12:00 UTC on Monday, targeting 42.2 million eligible users out of the 53 million active within the Telegram ecosystem. Token distribution was based on factors such as account age, user activity, and ownership of Telegram-specific badges. To prevent overwhelming the TON blockchain, the DOGS team implemented a staggered launch strategy. This allowed users to claim their tokens via centralized exchanges (CEXs) before the official token generation event and trading, thereby easing the initial pressure on the network. By directing users to deposit tokens directly into exchanges, the strategy aimed to distribute traffic more evenly across CEXs like Binance, KuCoin, and OKX, which listed DOGS tokens for trading from day one.

Despite the staggered approach, the network encountered its first major outage at around 11:00 UTC on Tuesday, lasting approximately seven hours. The disruption occurred due to the abnormal load on TON, which overwhelmed several validators. Many validators were unable to clean their databases of old transactions, leading to a loss of consensus and halting block production. Major exchanges like Bybit, responded by temporarily suspending TON deposits and withdrawals to mitigate further disruption

A second outage occurred due to the continued heavy load from DOGS token minting at 19:19 UTC on Wednesday, lasting over four hours. The TON Foundation quickly coordinated a recovery effort, instructing validators to restart their nodes to resume block production. Although consensus was restored, network performance remained suboptimal as the DOGS claim process continued.

Since then, the TON blockchain has resumed block production, with validators updating their nodes to stabilize the network. While some performance issues persist, this incident served as a critical stress test, revealing areas where TON needs improvement as it scales.

To further enhance the network’s stability, the TON Foundation introduced a TON Validator Information Form, encouraging validators to share key setup details. The initiative aims to optimize network performance, particularly in anticipation of future high loads, demonstrating TON’s commitment to strengthening its infrastructure and meeting growing user demand.