Middle East Tensions, Cross-Chain Solutions, and the Future of DeSci

Seventh edition of the Ryze Roundup.

Market Commentary

This week, markets were gripped by escalating geopolitical tensions in the Middle East, following the exchange of offensives between Iran and Israel. Investors remain on edge as the risk of conflict escalation looms, with Israel considering its retaliation strategies. On Thursday, bitcoin dipped below the $60,000 mark, while altcoins saw broad-based sell-offs across the board.

On Monday, Jerome Powell dampened expectations for aggressive rate cuts, reinforcing that 50bps reductions are not the norm and that future moves will be data-dependent. Last week, markets were overly optimistic, pricing in a 50bps cut at the upcoming FOMC meeting. However, we maintain our forecast of two additional 25bps rate cuts by year-end.

We've previously highlighted the potential for outflows from money market funds as Treasury yields decline, and this is now evident in the contraction of yield-bearing stablecoins. Their total market cap has shrunk from a July peak of $3.82 billion to $3.21 billion currently. Despite this, Aave v3 continues to dominate, holding over $15 billion in TVL, just shy of its $16.45 billion all-time high. We anticipate idle capital will increasingly seek higher-yield assets as the Fed continues its rate-cutting cycle.

“Ryze’s house view is that a resurgent Aave is an early harbinger of a broad-based DeFi comeback. Of considerable note: Trump-affiliated World Liberty Financial is an Aave instance. Custom front end but Aave stack. Worth a watch.” – Matthew Graham, managing partner.

On the economic front, Tuesday’s manufacturing PMI for September came in below expectations, pointing to further weakness in the U.S. economy. However, the JOLTS report surprised to the upside, with job openings surpassing 8 million in August, signaling resilience in the labor market. We look forward to today’s non-farm payrolls and unemployment data for further guidance.

Key News & Events

LayerZero x EigenLayer: A New Framework for Cross-Chain Security

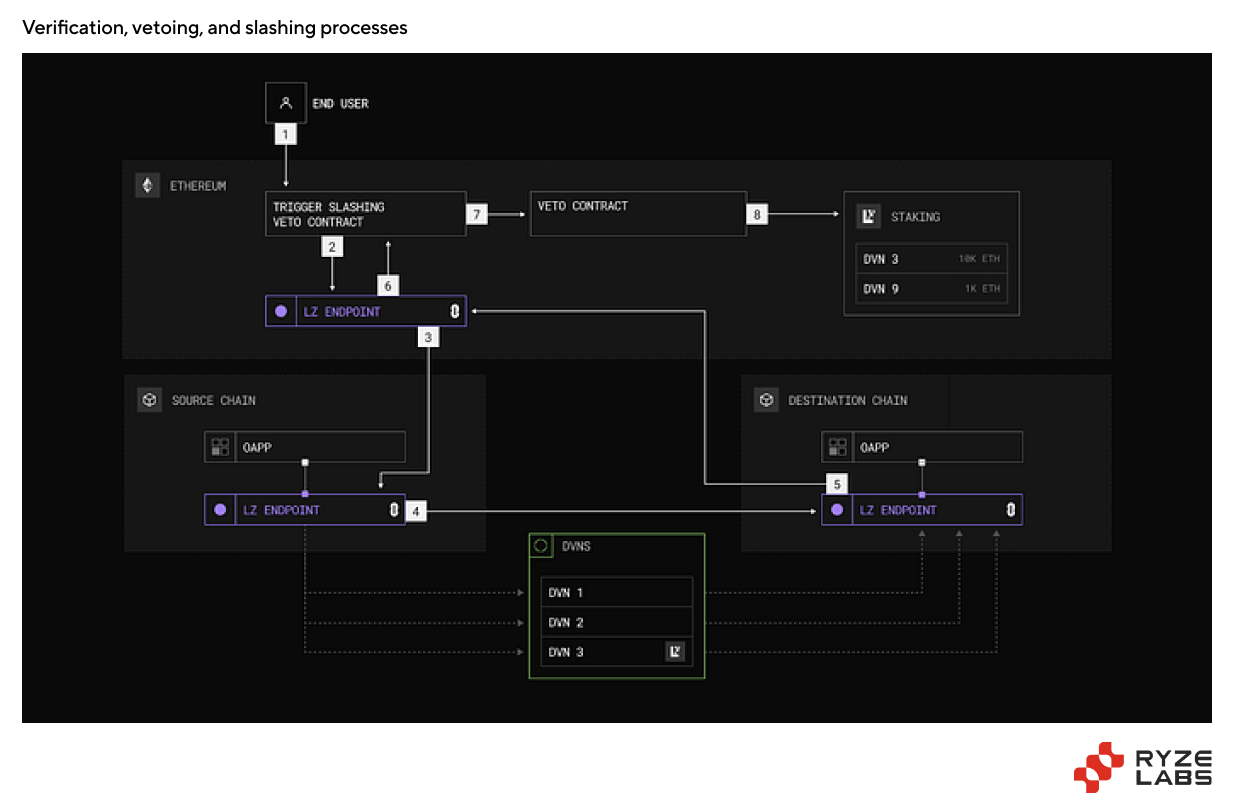

LayerZero Labs and Eigen Labs have introduced a Cryptoeconomic Decentralized Verifier Networks (DVNs) framework aimed at strengthening cross-chain communication security. DVNs are off-chain systems that verify messages between blockchain networks, ensuring reliable and accurate data exchange. This collaboration combines LayerZero's messaging capabilities with EigenLayer's cryptoeconomic approach, marking a significant advancement in secure, economically-backed blockchain messaging.

The DVN framework integrates technical verification with financial incentives, where verifiers stake assets (ETH, ZRO, or EIGEN) to back their commitments. If they act dishonestly, penalties (slashing) are applied. This mechanism addresses critical challenges in cross-chain messaging by creating economic incentives for honesty and broadening security participation. By introducing an economic layer of accountability, DVNs make dishonest behavior financially costly, shifting the trust model from reliance on integrity to one that is economically secured.

The framework operates through four key steps: staking, verification, vetoing, and slashing. Verifiers lock assets as collateral, and if discrepancies arise, token holders can vote on slashing decisions. This transparent and accountable process enhances cross-chain security.

EigenLayer leverages Ethereum’s existing security to support multiple chains, while LayerZero serves as a marketplace for verifiers, offering flexibility in choosing DVNs with varying security levels. Currently, 35 entities, including zk-proof teams like Polyhedra and oracles like Google Cloud, participate as verifiers.

As blockchain networks grow, DVNs offer a scalable, secure solution for cross-chain interoperability. The open-source nature of the framework allows for the creation of customized DVNs, further expanding its applicability. The growing trend toward app-specific blockchains (RollApps) increases demand for interoperability solutions like LayerZero, making secure, decentralized messaging more critical than ever.

“Bootstrapping economic security is an enormous task and we may have a solution. EigenLayer’s mechanism for coordinating trust at a global scale is one of the more fascinating recent industry innovations.” – Matthew Graham, managing partner.

Decentralized Science (DeSci): A Growing Web3 Vertical Addressing Gaps in Traditional Research

Decentralized Science (DeSci) leverages blockchain technology to foster open, incentivized, and community-driven scientific research. Traditional R&D often remains proprietary, while academia faces challenges with resource allocation and management. Problems such as self-citations, fabricated data, and a focus on trending research topics hinder progress. DeSci aims to address these inefficiencies by using blockchain as a coordination layer, enabling improved funding for early-stage and niche projects, data sharing, collaboration, and transparent publishing.

Several DeSci projects are making strides in different research areas. For example, Research Hub ($RSC) decentralizes the peer review and publication process, making it more transparent and efficient while incentivizing reproducibility through token rewards and reputation systems.

VitaDAO focuses on longevity research, sourcing over 200 projects and investing $3 million in research. With more than 2,000 token holders, including Pfizer, VitaDAO circumvents traditional corporate and governmental bottlenecks, supporting high-risk, early-stage projects typically underfunded by biotech firms. These smaller grants ($75-250k) are crucial for advancing ideas through the “Valley of Death” before receiving VC or institutional backing.

The Innovation Game ($TIG) improves algorithm optimization by creating a marketplace that aligns the financial interests of stakeholders. TIG targets problems that are easy to verify but difficult to compute. Innovators develop algorithms, and miners test them for efficiency, with incentives for sharing the best solutions. These algorithms can then be licensed as intellectual property across various industries.

“At least for now DeSci may be more at the frontier than ready for prime time but it could play a valuable role in edge cases such as scientific research that is too controversial to coordinate and incentivize by other means.” – Matthew Graham, managing partner.

Despite being relatively underappreciated, DeSci is emerging as a real-world solution, tackling inefficiencies in scientific research. Like DePin, it is another vertical that works on real-world issues and helps the industry build a reputation.