Market Commentary

Markets got hit with a macro shock on Wednesday, but then shrugged it off.

Bitcoin and equities both sold off early in the U.S. session after weak economic data raised fresh recession fears. Q1 GDP came in at -0.3%, the first contraction since 2022, driven in part by a 41% surge in imports as companies rushed to front-run possible Trump-era tariffs. Jobs data also missed badly, with private payrolls rising just 62K, the weakest since last July.

The initial reaction was textbook risk-off: BTC dropped nearly 2%, and major stock indices opened sharply lower.

But by Thursday morning, everything had reversed. BTC bounced hard and is now up 4.2% on the week, trading just under $97,000. Equities followed suit. The S&P 500 (SPY) gained ~1.8% over the last four sessions and logged its seventh straight daily gain by April 30. That’s the longest winning streak since March 2022.

So what changed?

A few things. First, the data, while weak, raised expectations for a more dovish Fed down the line. Second, big tech earnings turned sentiment around. Microsoft crushed its Q3 numbers: $70.1B in revenue, 18% EPS growth, and accelerating Azure growth (+34–35%). Meta followed with strong results of its own, citing AI-driven engagement and ad strength.

The rebound spilled into crypto. However, BTC may still face pressure. Glassnode noted that long-term holders are sitting on 350%+ unrealized gains, which could lead to profit-taking.

Meanwhile, SUI continues to lead alt L1s, more than doubling since its April 7 low and adding $6B in market cap. It’s the strongest bounce in the sector, helped by on-chain activity and fresh inflows chasing momentum.

Key News and Events

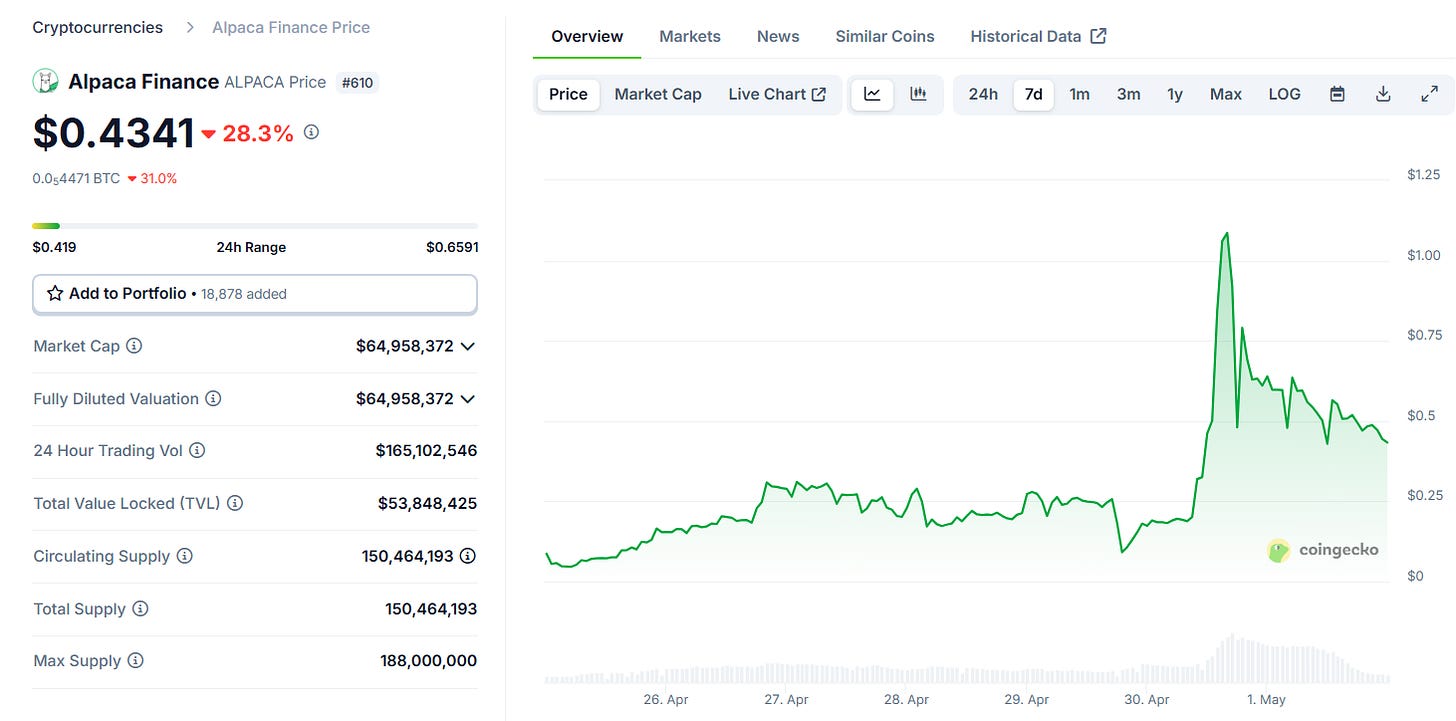

Binance Delisting ALPACA Event: Surge, Short Squeeze and Market Warning

On April 24, Binance announced it would delist ALPACA and three other tokens on May 2 due to concerns around liquidity, security, and transparency. The decision followed internal reviews and community voting, where ALPACA received 6.3% “high-risk” votes.

Rather than declining, ALPACA surged following the announcement. After an initial drop to $0.029, the token spiked 93% in one hour and ultimately reached $1.27, marking a 40x rally. Market cap rose from under $6 million to $191 million. Daily volume exceeded 12x its market cap, a sign of speculative excess.

This extreme move appears linked to coordinated short-squeeze dynamics. Whales likely used the delisting to trigger panic selling and attract short interest before aggressively driving the price higher. Binance’s contract funding rates, which reached -2% hourly, significantly raised the cost for shorts, compounding the squeeze.

Alpaca Finance denied involvement in manipulation but canceled its planned token issuance amid backlash. Binance’s He Yi alluded to “shell-buying funds” behind the move but offered no evidence. Retail traders who chased the rally or shorted with leverage saw sharp losses.

The incident underscores the risks of thinly traded tokens and low-float assets subject to manipulation. It also raises questions around how delisting announcements can intersect with the futures market. For investors, this serves as a warning: be vigilant about the risks of low market cap, highly controlled tokens, and exercise caution with high-leverage speculation driven by abnormal signals such as "delist and surge."

Worldcoin Back in the News

In 2023, Worldcoin, now rebranded to World Network, conducted small tests of their iris-scanning technology in the U.S. market but it was not until this week that they’ve committed to launch their biometric identity verification system in San Francisco, Miami, Nashville, Los Angles, Austin, and Atlanta to deploy 7,500 orbs by the end of 2025. The expansion of the U.S. footprint will help grow the current base of people who have had their irises scanned, which stands at 12 million people across 100 countries.

Worldcoin data has the potential to lower fake account errors by ensuring that a user is human and the identified individual. This becomes increasingly important as AI has made it easier to bypass traditional fraud protections.

Of course, the adjacency of Sam Altman, officially a co-founder of “World” and CEO of OpenAI, has helped the token associated with World, $WLD, which has been able to maintain an FDV over $10 billion.