Market Correction Deepens, Trump’s Policies Keep Investors on Edge

Ryze Roundup

Market Commentary

Bitcoin is down 7% this past week, while ETH and SOL have dropped 16%, extending the market-wide correction. The ETH/BTC ratio has now fallen to pre-DeFi summer levels, underlining ETH’s persistent underperformance over the past three years.

Bitcoin briefly surged toward $90,000 last Friday, driven by optimism from Trump’s White House Crypto Summit, which signaled a potential shift in U.S. policy toward digital assets.

However, the rally was short-lived as macro concerns took over. Trump’s tariff escalation and vague economic messaging triggered a sharp sell-off across risk assets, dragging Bitcoin down to $77,000 by Tuesday.

Relief came midweek as softer-than-expected CPI data on Wednesday showed inflation rising 2.8% YoY, below the 2.9% forecast. This marked the slowest annual increase since early 2024, fueling a temporary rebound in risk assets, but it was not enough to bring BTC back to its previous levels.

With inflation cooling, the Fed is likely to hold rates steady at its March 18-19 meeting, as already priced in by markets.

However, the real issue isn’t the Fed—it’s Trump. His policies are the biggest wildcard for markets right now, and while we don’t buy into the idea that he’s deliberately engineering a recession, he’s clearly playing a complex economic game with uncertain outcomes.

The equity market reflected the same volatility, with the S&P 500 dropping 2.7% and the Nasdaq suffering its worst day since 2022, falling 4% on Tuesday.

For crypto, this correction remains within the norm of a bull run—shaking out leverage before the next move higher. But until there’s more clarity on trade policies and their impact, expect the market to remain fragile.

Key News and Events

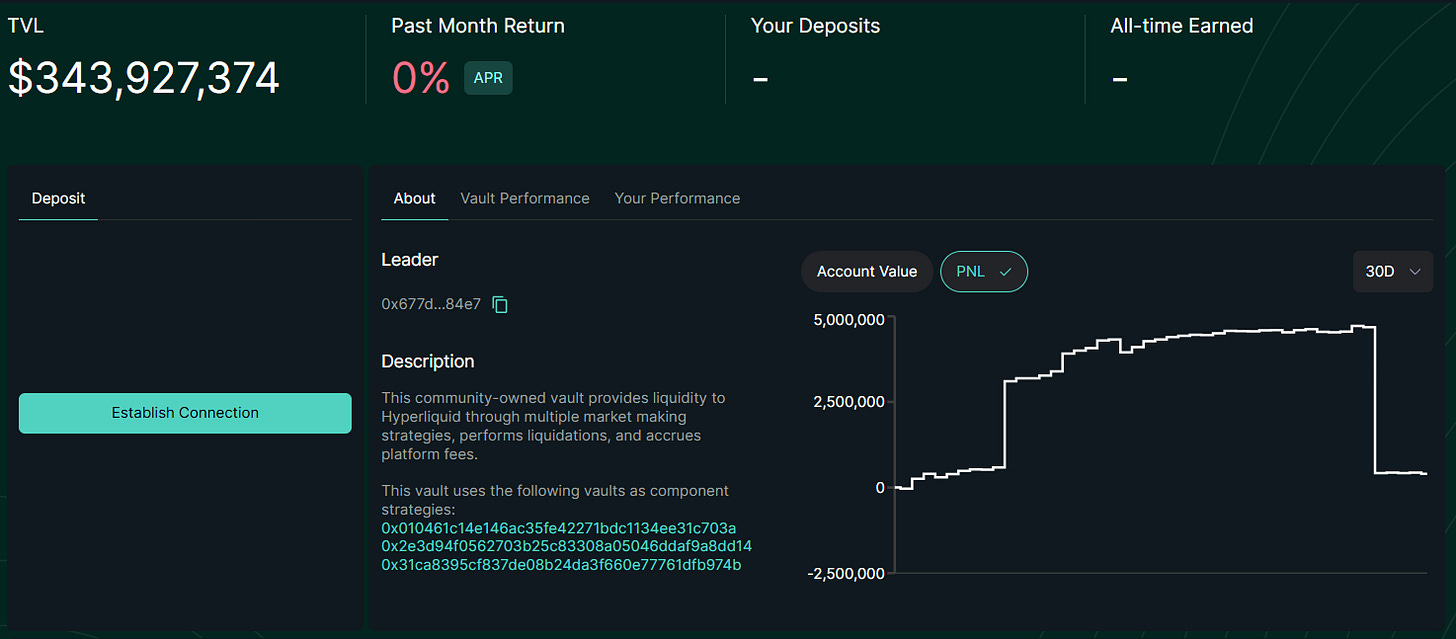

Hyperliquid Whale Event: High-Leverage Trading and the Fragility of DEX Risk Management

A trader known as “Hyperliquid 50x Whale” made headlines this week with a high-leverage strategy that exposed vulnerabilities in DEX risk management. On March 12, the trader deposited $15.23 million USDC into Hyperliquid, using 50x leverage to open a 175,000 ETH long position worth $343 million. As the whale kept adding to the position, ETH’s price moved higher, creating FOMO-driven momentum. The trader closed the position for a $1.86 million profit, withdrew $17.09 million USDC, and triggered a wave of forced liquidations.

Unlike CEXs, Hyperliquid allows traders to withdraw unrealized profits and has no position limits. Its oracle-based liquidation system also differs from CEX order books, leading to a $4 million loss for the HLP insurance vault when 160,000 ETH was liquidated.

While CEXs use tiered margin, position limits, and insurance funds, DEXs attract traders with zero gas fees and high leverage, but this comes with risk—Hyperliquid sees $400 million in daily liquidations, compared to Binance’s $53 million.

Hyperliquid responded by lowering maximum leverage to 40x for BTC and 25x for ETH, while raising margin requirements for large positions. However, it did not impose position limits, maintaining its focus on unrestricted trading. The event highlights a key issue in DeFi: DEXs offer transparency but still lack the risk controls of CEXs. While centralized platforms have spent years refining liquidation processes, DEXs remain in an earlier stage of development, requiring further improvements to handle extreme market events.

Coinbase Registers with India’s FIU, Signaling Renewed Market Strategy

Coinbase has registered with India’s Financial Intelligence Unit (FIU), marking a key step in its effort to re-enter one of the largest emerging crypto markets. The FIU, which enforces India’s anti-money laundering (AML) laws, requires compliance with strict KYC, transaction monitoring, and reporting obligations under the Prevention of Money Laundering Act (PMLA).

Coinbase first entered India in 2022 but halted local services due to regulatory roadblocks and informal opposition from the Reserve Bank of India (RBI). This new registration paves the way for a strategic re-engagement, with plans to resume retail crypto trading later this year and potentially expand into additional investment products.

While India has a growing blockchain development ecosystem, the country’s crypto taxation policies remain a challenge. The 30% flat tax on crypto profits, 1% Tax Deducted at Source (TDS), and restrictions on loss offsets have driven trading volumes to offshore platforms. Despite these hurdles, Coinbase’s return suggests cautious optimism that regulatory adjustments could be on the horizon.

By securing FIU approval, Coinbase enhances its compliance standing and improves its prospects for operating in India’s evolving regulatory environment. Whether this move signals broader policy shifts remains to be seen, but it marks a notable step in rebuilding market confidence.