Marinade: Unlocking Value in Solana's Liquid Staking Market

Why We Invested in Marinade

Disclosure: Ryze Labs has acquired a fully-liquid MNDE position from the open market. As always, nothing below should be construed as financial advice, please do your own

In the Solana ecosystem, 67% of the total SOL supply is currently staked, with a significant 93% of it being natively staked. This is in contrast to Ethereum, where only 28.3% of the total ETH supply is staked, and over 40% of that is liquid staked. The primary reason behind this disparity lies in Solana’s delegated proof-of-stake consensus, which allows SOL holders to delegate their tokens directly to validators. However, the main limitations of native staking on Solana are the unstaking “cooldown period” of one epoch or around two days, and the lack of fungibility of staked positions.

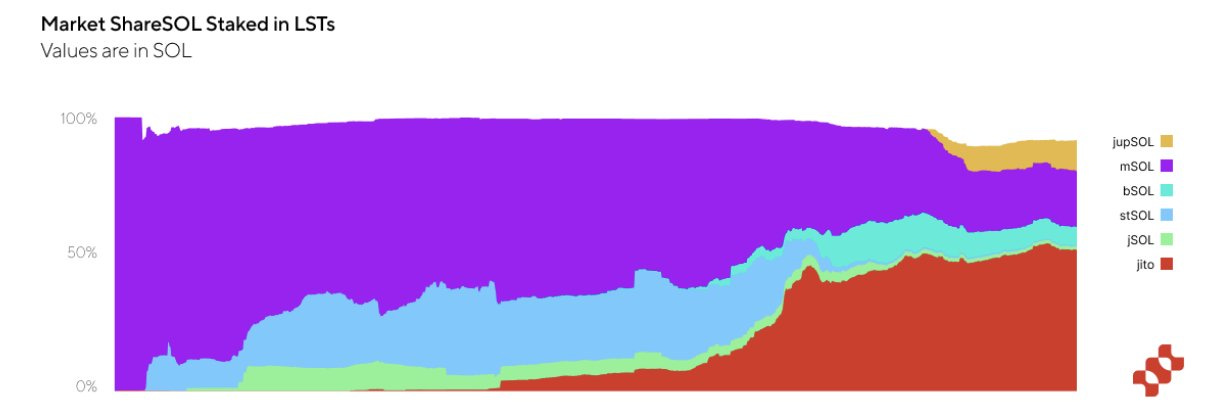

Liquid staking overcomes these limitations by allowing users to maintain liquidity of their staked assets while also earning staking rewards. As of now, liquid staking on Solana accounts for 7% of the total staked SOL, a figure that has been steadily rising since late 2022. Initially, Marinade and Lido dominated the liquid staking landscape. However, the rise of Jito Lab’s MEV client has shifted the balance, with JitoSOL capturing a market-leading 44.7% share, while Marinade’s mSOL has gradually declined from a peak of 64% in October 2022 to approximately 20% today.

The Complexities and Risks of Liquid Staking

Despite the benefits of liquid staking, several risks have hindered its growth on Solana:

Smart Contract Risk: The underlying liquid staking token (LST) protocols expose users to potential smart contract vulnerabilities.

Diminished Yields: Multiple layers of commission, including those for validators and the staking protocol, can reduce the overall returns.

APY Dependency: The returns are highly contingent on the delegation strategy employed by the LST protocol.

These factors have driven the market dynamics in which over 90% of staked SOL remains natively staked. Yet, native staking is not without its own challenges, such as the counterparty risk associated with the delegated validator. In most cases, users tend to delegate to validators with the largest existing stakes, inadvertently contributing to centralization. Currently, Solana’s top 19 validators control over 33% of the total staked SOL, a threshold known as the “superminority.”

Marinade V2 and Marinade Native

To address these challenges and capture a massive untapped market, Marinade has introduced Marinade Native, a non-custodial native staking solution. Through Marinade Native, users maintain full control over their assets by retaining their "withdraw authority," while Marinade only controls the "stake authority," which is used to delegate to validators. This model significantly enhances security and mitigates the risks traditionally associated with liquid staking.

Key features of Marinade Native include:

Stake Auction Marketplace (SAM):

Marinade has introduced a competitive marketplace where validators bid for delegated stakes, sharing a portion of their revenue with stakers. This competitive environment ensures that stake flows to the most performant validators, with stakers potentially earning yields 100-200 basis points higher than the average native staking yield. SAM currently has participation from over 150 validators, most of which operate outside the top 19 validators, promoting both performance and decentralization across the network.

Protected Staking Rewards (PSR):

Marinade’s PSR program provides an additional layer of security for stakers. Validators are required to set aside 1 SOL for every 10,000 SOL of Marinade stake as a bond. This bond is used to compensate users for any lost yield due to validator downtime or commission changes. To date, Marinade has successfully executed over 4,600 protection events, disbursing more than 10,600 SOL to ensure stakers receive the highest possible APY.

Driving Growth and Institutional Adoption

Since the launch of Marinade Native and other protocol enhancements in October 2023, Marinade has increased its total value locked (TVL) by approximately 2.5 million SOL.

Several strategic initiatives have contributed to this growth:

Deepening mSOL Liquidity: Marinade’s MNDE Earn Season 3 initiative has bolstered mSOL liquidity by approximately $10 million across Raydium and Meteora pools.

Fee Reduction: By reducing the mSOL management fee to 0%, Marinade increased its APY by 0.4%, making mSOL even more competitive for stakers.

Moreover, Marinade has made significant strides in positioning itself as the go-to staking solution for institutional players. Its staking marketplace has been designed to meet the needs of institutional investors, offering a custody-agnostic platform. Partnerships with prominent custodians like Zodia and Copper ensure that institutions can easily stake SOL with Marinade, laying the foundation for future growth in institutional demand for staked assets.

This could be significant in a world where solana spot ETFs with staking are approved. Even though that might not seem like a near-term possibility, the crypto regulatory landscape has been changing with haste, and the upcoming U.S. elections could prove a pivotal regulatory shift in favor of our industry.

Conclusion

Marinade is uniquely positioned to drive further decentralization and performance improvements in staking. By addressing key risks associated with both liquid and native staking and expanding its reach through institutional adoption, Marinade is set to capture a growing share of the staked SOL market. The introduction of Marinade Native and innovative programs like SAM and PSR not only improve yields for users but also contribute to the long-term decentralization and resilience of the Solana network.

We believe Marinade’s approach aligns with the broader trend of creating a more efficient and decentralized ecosystem, and that they will be a key player in the future of Solana’s institutional staking landscape.