Market Commentary

This past week has been relatively quiet, with muted price action across the markets. Funding rates have turned negative across the board, reflecting a shift in sentiment. Flows into Bitcoin and Ethereum Exchange-Traded Funds (ETFs) have slowed significantly, often trading below a cumulative $100 million daily, with many ETFs experiencing no inflow on most days. Notably, Bitcoin has seen several consecutive days of negative funding, signaling growing pessimism not witnessed since October 2023, just before Bitcoin surged from $28,000 to $35,000.

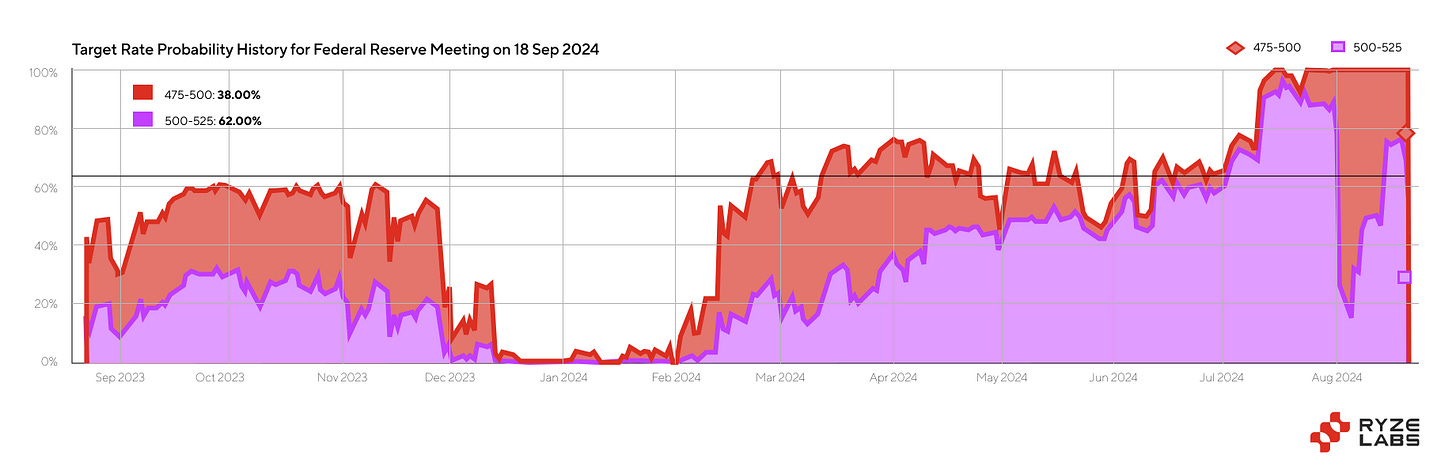

The most significant macroeconomic development this week was the revision of nonfarm payroll figures, revealing that 818,000 fewer jobs were added between March 2023 and March 2024 than previously reported. This marks the largest downward adjustment to job growth since 2009, indicating a weaker U.S. job market than anticipated. As a result, the probability of a 50 basis point rate cut in September has increased from 22% to 35%.

Meanwhile, the U.S. Dollar Index (DXY) has declined by 5% against other currencies in recent weeks, while gold continues to push past all-time highs. This trend could signal a positive outlook, as it encourages increased lending and supports global economic recovery. Additionally, lower interest rates diminish the appeal of holding money market funds or treasuries, potentially driving capital toward riskier assets.

We’re closely watching Federal Reserve Chair Jerome Powell’s upcoming speech at Jackson Hole on Friday. Markets are currently positioned for dovish remarks, which leads us to believe that any unexpected hawkishness could introduce significant downside risk.

“Macroeconomic factors are the number one driver of crypto performance and have been a drag on performance for some time now. It’s Ryze’s view that impending rate cuts represent a bullish catalyst for what is fundamentally a risk-on asset class, although by the time rate cuts are actually announced much of the benefit may have already accrued.” – Matthew Graham.

How Has Bitcoin Reacted to Past Rate Cuts?

Over the past five years, the Federal Reserve has implemented five rate cuts: three in 2019 and two in 2020 during the onset of the COVID-19 pandemic. At that time, Bitcoin and the broader crypto industry were significantly smaller in terms of trading volume, institutional interest, and overall market development. While there aren’t enough data points to draw definitive conclusions, a pattern does emerge from the historical data.

Out of the five rate cuts, four were “sell the news” events, where Bitcoin’s price declined following the announcement. The only instance of a bullish reaction occurred when the Federal Reserve set the interest rate to 0.25%. Additionally, in just two out of the five cases, Bitcoin’s price was higher two months after the rate cut compared to the price on the day of the cut.

Key News and Events:

DOGS Token Generation Event (TGE)

The recent launch of DOGS, a memecoin on The Open Network (TON), has captured significant attention within the Telegram community, which boasts over 50 million monthly active users. As a mini-application within Telegram, DOGS rewards users based on the age and activity of their Telegram accounts, creating a seamless and engaging experience within the platform.

The mechanism behind DOGS is straightforward: users grant the mini-app access to their Telegram accounts, and, depending on the longevity and activity of those accounts, they receive DOGS tokens. Notably, users with older accounts, those holding a Telegram Premium subscription, or those possessing the OG badge—signifying early and active participation in Telegram—are eligible for additional rewards.

The project’s identity is rooted in Spotty, an iconic character drawn by Telegram founder Pavel Durov during a charity auction. This link reinforces DOGS' alignment with the broader Telegram community, aiming to introduce millions of people to blockchain through its app and tokenized stickers, while fostering a fun and engaging ecosystem centered on community ownership and fair reward distribution.

DOGS is set to launch an airdrop of over 400 billion tokens on August 26, with 42.2 million eligible users out of 53 million. The tokenomics of DOGS are designed for broad distribution, with 81.5% of the total supply allocated to users. The total supply is capped at 550 billion DOGS, with the remaining tokens reserved for the team, future development, liquidity, and listing activities.

Users can claim tokens via Telegram Wallets or centralized exchanges (CEXs). Claims will be open on CEXs until today, while non-custodial wallet claims will be available until August 26, with some exchanges even offering gasless claims. This staggered launch mechanism is intended to prevent the TON blockchain from being overloaded with claims, ensuring a smooth rollout while driving user traffic to centralized exchanges. The DOGS token has secured listings on fifteen centralized exchanges, including major platforms like Binance, Gate.io, KuCoin, and OKX, with trading scheduled to begin on August 26.

Future plans include the introduction of meme stickers that can be minted and traded on-chain, using DOGS tokens. We expect the upcoming DOGS launch to have spillover effects on-chain, bringing more web2 Telegram users onto TON.

“TON projects continue to demonstrate that TON’s unique ‘loose coupling’ with Telegram allows for projects to rapidly scale to user numbers which are almost impossible to replicate in other L1 ecosystems.” – Matthew Graham.