Implications of Tax Structures on Virtual Digital Assets

Does formal recognition of virtual assets put a strain on traders due to increased taxation?

by Noah Roy, investment analyst at Ryze Labs

Overview

India passed the Finance Bill last year, recognizing cryptocurrencies as virtual digital assets (VDA) and implementing a tax on profits made from transacting with these assets. This tax law has been met with both praise and criticism. It brings a certain amount of clarity to the taxation of virtual assets by bringing it under the purview of the government. However, the tax rate of 30%, which is equivalent to the highest income tax bracket, and the lack of recognition of losses, are seen as attempts to curb cryptocurrency transactions.

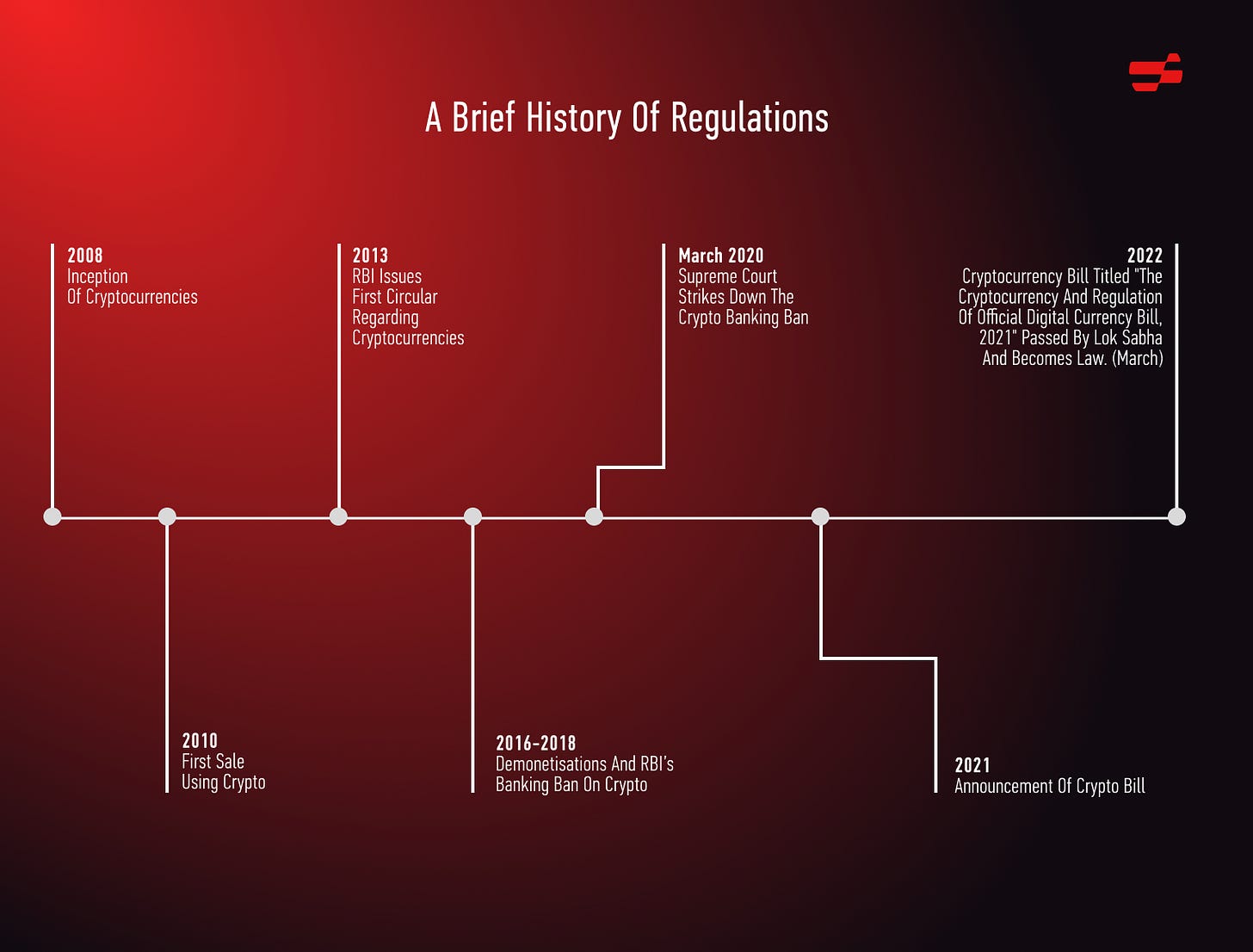

India's approach toward the regulation of cryptocurrencies has been quite dynamic over the last few years. From the initial skepticism and outright ban proposed by the Reserve Bank of India (RBI) to the recent recognition of cryptocurrencies as VDAs and the implementation of taxation, the Indian government’s stance towards digital currencies has gone through a number of changes over the years.

Here is a brief timeline of Indian cryptocurrency regulation, highlighting the key events, decisions, and policies that shaped the industry in India.

Regulatory Timeline

2013–2017

The existence of cryptocurrencies was initially recognized by Indian law via circulars published by the RBI. These circulars informed “users, holders, and traders” of cryptocurrencies about their potential hazards.

2018

Following the initial circulars, the RBI issued a statement on April 5th, 2018 ordering all its regulated entities (banks, non-banking financial companies, and payment system service providers) to cease dealing in virtual currencies and providing services to facilitate such dealing or settlement. Furthermore, any regulated entities who currently provide such services must cease these activities within three months of the circular’s date. In 2018, a writ petition was filed against this same circular.

2020

On March 4th 2020, in the case of the Internet and Mobile Association of India vs RBI, the Supreme Court of India adjudicated the case in favor of permissionless Web3 ecosystems. This result was an important predictive indicator of the public sector’s recognition of crypto’s strategic and economic value.

2020 also saw the release of the first of a two-part draft strategy document titled Blockchain: The India Strategy According to the paper, blockchain technology may be used to improve business and governance processes. The strategy recognized cryptocurrencies as a unique asset class that could represent network ownership (like shares of a firm, for example) and also serves as a fundamental unit of value exchange.

2021

In January, the Ministry of Electronics and Information Technology issued a sequel to the National Strategy on Blockchain paper, over a year after the first strategy paper publication. The ambiguous nature of tokens, lack of Know-Your-Customer (KYC) norms, non-inclusion in the digital signature framework, and lack of adequate data protection provisions were all highlighted as regulatory gaps in the legacy system. The strategy sequel listed a wide range of potential blockchain applications of national interest including logistics, supply chain management, identity management, e-voting, IoT device management and security, and microfinance for self-help groups (SHG) to name a few.

In early January, the RBI issued a booklet titled ‘Payments and Settlement Systems in India, Journey in the Second Decade of the Millennium 2010–2020’ in which it defined a CBDC as “a legal tender and a central bank liability in digital form denominated in a sovereign currency and appearing on the central bank’s balance sheet. It is in the form of electronic currency which can be converted or exchanged at par with similarly denominated cash and traditional central bank deposits.”

The Ministry of Corporate Affairs issued a notification on March 24th 2021, amending Schedule III of the Companies Act, 2013. Schedule III specifies how businesses must generate profit and loss statements and balance sheets for submission to the government. The updated Schedule III requires Indian enterprises to report the following information.

Profit or loss on transactions involving cryptocurrency

Amount of currency held as of the reporting date

Deposits or advances from any person for the purpose of trading or investing in cryptocurrency

Responding to reports that certain banks were still quoting from the RBI’s earlier circular, the RBI issued a circular on May 31st 2021, where it clarified that banks and regulated entities were no longer bound by the earlier 2018 circular, as it was no longer valid in light of the SC Judgment.

2022 and beyond

The new tax regime signals the government's shift on crypto and is moving forward to regulate it instead of an outright ban. The Union Budget 2022-23 introduced the following provisions with regard to virtual digital assets:

(a) A levy of a flat 30 per cent tax on gains from VDA trade applicable from April 1st, 2022

(b) A levy of 1 per cent tax deducted at source (TDS) on transactions above INR 10,000 from July 1st, 2022

(c) The provision disallowing the offsetting of losses applicable from April 1st, 2022

The Finance Bill in India differentiates digital assets from traditional currencies backed by the central bank. The definition of VDAs is broad and includes all types of cryptocurrencies, tokens, and non-fungible tokens. However, the meaning of this term is still evolving and a circular from June last year excluded certain instruments such as gift vouchers, reward points, and subscriptions from being considered virtual digital assets.

The Finance Bill's 115 BBH section states that the following actions are considered taxable events:

Exchange of virtual digital assets (VDAs) for Indian rupees or any other fiat currency

Trading one type of virtual digital asset for another type, including stablecoins

Using virtual digital assets to purchase goods or services

The bill imposes a 30% tax on profits generated from virtual digital asset transactions, such as converting virtual digital assets to fiat currency, trading one type of virtual digital asset for another and using virtual digital assets to purchase goods or services. Transactions above 10,000 rupees also have an additional 1% tax. However, certain types of transactions like gifting, staking rewards, airdrops, mining and decentralized finance transactions are considered income and the taxes are calculated based on the recipient's income tax rate. Holding and selling virtual digital assets later will be subject to a 30% tax on any increase in the assets' market value.

One of the main criticisms of the cryptocurrency tax law in India is that it does not allow for losses to be recognized, meaning individuals cannot offset capital gains with losses or business expenses. This clause is seen as a way for the government to discourage cryptocurrency transactions and reduce speculation by traders. In a highly volatile market, the clause limits the options of the market participants to hold the asset long term than indulge in active trading.

The consequence of the tax structure changes are as follows

After the announcement of a new tax regime in India, there was a significant increase in the amount of trade volume, totaling around USD 3.852 billion, moving from domestic centralized VDA exchanges to foreign ones, during the period of February to October 2022. Specifically, a large portion of this volume, amounting to USD 3.055 billion, was moved offshore within the first six months of the current financial year.

Domestic centralized VDA exchanges trading volumes decreased by 15% between February and March 2022 and an additional 14% between April and June 2022 due to the Union Budget 2022 announcement of a 30% tax on gains, no provision to write off losses and a 1% TDS. The one percent TDS had the biggest negative impact, resulting in an 81% decrease in trading volumes on Indian VDA exchanges from July to October 2022.

Following the Union Budget announcement in February 2022, many Indian VDA users have been moving from domestic centralized VDA exchanges to foreign ones, with an estimated 1.7 million users switching over. This trend can be seen starting in February 2022. Additionally, the adoption of VDA by Indians, as measured by mobile app downloads, decreased by 16% on a month-on-month basis for domestic exchanges from July to September 2022, while it increased by the same amount for foreign exchanges during the same period.

The new tax policy in India also creates a strong disincentive for VDA traders to trade on domestic exchanges, particularly small traders, and encourages them to move their liquidity offshore, making the tax policy ineffective. Furthermore, the lack of clarity in regulations in the growing VDA industry can lead to capital outflow, discourage international investors and lead to the investments being directed to other markets, diminishing the competitiveness of Indian VDA projects, companies and exchanges compared to foreign counterparts. This may also encourage companies to register in other jurisdictions thus reducing tax for the government. This has been a trend among Indian startups in the recent past as well.

Additionally, a high flat tax rate may not be the best approach to maximize tax revenue from the industry, as it may prompt investors to evade taxes through increased P2P and gray market trading, decreasing transparency in VDA transactions and increasing financial risks.

India's tax treatment for VDAs is also less favorable compared to other countries with high VDA adoption rates, such as the USA, the Philippines, or Brazil. To mitigate negative effects on the industry, research after a critical examination by the Esya Centre suggests the following,

The tax deducted at source (TDS) mandate rate currently at 1% should be lowered, akin to the securities transaction tax, i.e 0.01%.

The government should conduct a Laffer-Curve analysis to determine optimal taxation points while also implementing a progressive tax structure with different rates for short-term and long-term gains in line with international best practices.

Additionally, to address the high volumes of P2P trade, India should enhance international coordination and oversight of VDA exchanges, such as through a licensing scheme.

The Indian government took a progressive step towards taxing the VDAs as opposed to banning them. The step seems to have been a miscalculation as it is currently “killing the industry” as CZ put it. The risk to the financial stability of India is also high as it pushes the industry underground as it has in the past with regard to the gold market.

On the other hand, we see regional governments such as Telengana take the lead in setting up regulatory sandboxes to help the government, industry, regulators and users understand the changes necessary to integrate this key revolutionary technology into the larger economy. DLT and blockchain are key technologies which are changing the way people interact with each other.

The potential of this industry can not be disregarded as it provides jobs, skills and also revenue to the country. Supporting and nurturing the VDA industry can reap benefits for the country in the long term, propelling it to a high tech-based industry leader and helping to fulfill the prime minister's goal of a five trillion dollar economy.