Exploring the Feasibility of a Joint Currency & CBDC for Argentina and Brazil

Is it feasible for Latin America's biggest economies to pursue a shared currency? What are the complexities involved and is launching it as a CBDC a possibility?

by Juan Aranovich

0. Introduction

Argentina and Brazil, the two largest economies in South America, have long explored the possibility of a shared currency to streamline trade and cut operational costs. However, this article examines why a joint currency may not be the optimal solution for the two countries despite its potential benefits.

1. Incompatible Economies and Trading Structures

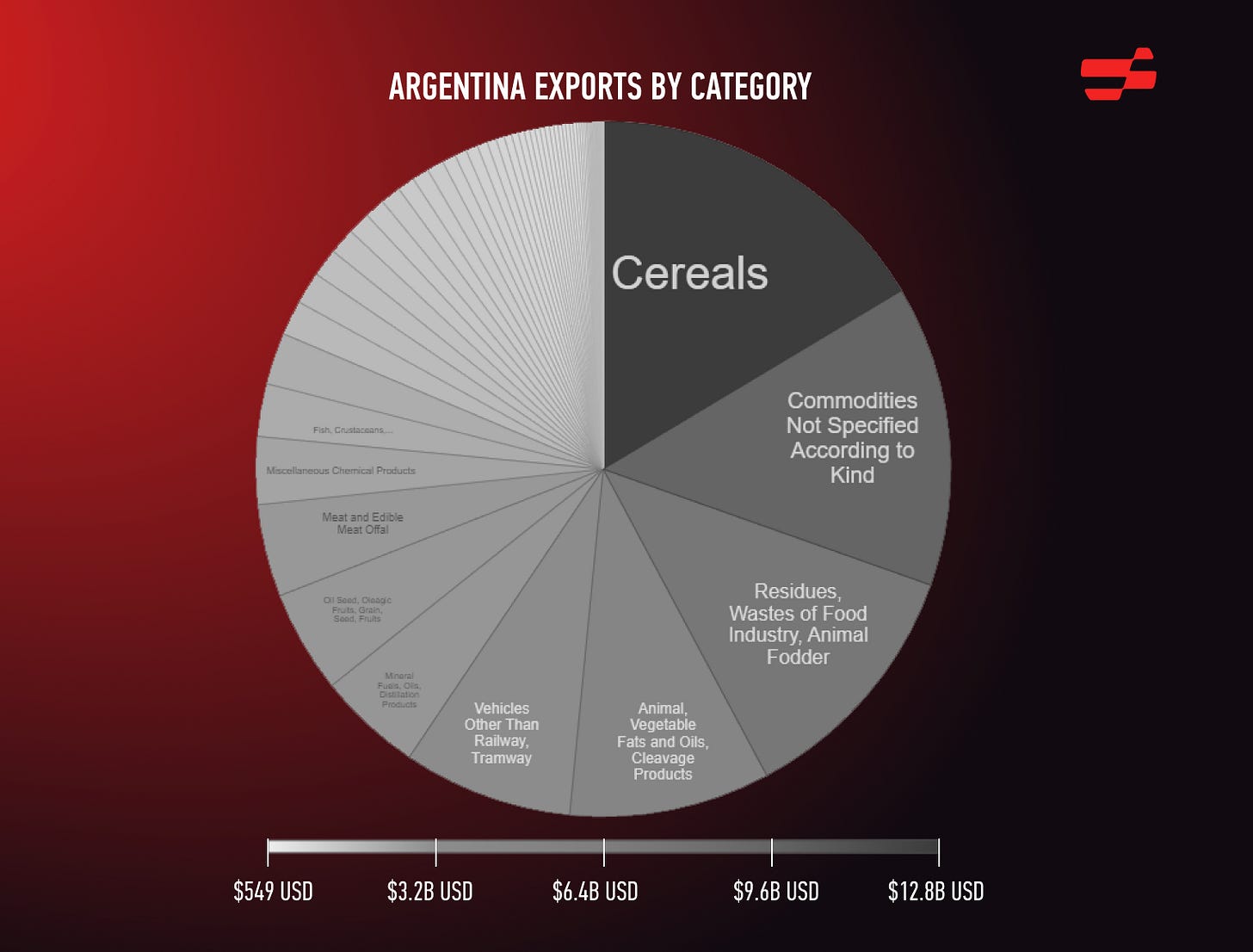

Argentina and Brazil possess distinct economic structures, where Argentina's exports are primarily agriculture-based and Brazil's exports consist mostly of manufactured goods and fuel. This divergence in economic structure heightens the probability of each nation being impacted differently by global economic shocks, leading to substantial fluctuations in the real exchange rate and trade disruptions.

Moreover, the trading volume between the two nations is imbalanced, with Brazil exporting only 4.2% of its total exports to Argentina, while Argentina sends 15% of its exports to Brazil, underscoring the difference in their trading patterns. The dissimilarities in their export types could significantly affect a joint currency. For example, a decrease in demand for a primary export could impact the joint currency's value and the overall economy.

China

China is the largest trading partner of Brazil, representing 27% of the country’s exports, while Argentina is the second largest trading partner, with 8% of its exports going to China. It is critical to consider the level of exports to China when evaluating the feasibility and stability of a joint currency between Brazil and Argentina. On one hand, a high volume of exports to China could bolster demand for the joint currency, rendering it a viable alternative to other currencies in global trade. On the other hand, a strong reliance on exports to China could render the economies of Brazil and Argentina more vulnerable to any changes or disruptions in the Chinese economy, potentially jeopardizing the stability of the joint currency.

2. Lack of Fiscal Coordination

Fiscal coordination is essential for a successful common currency, but the lack of it between Argentina and Brazil raises concerns about imbalances and trade disruptions. The high inflation rate in Argentina (almost 100%) and a presidential election in the near future, combined with Brazil's comparatively lower inflation rate (5.8%), highlights the potential for differing monetary policies between the two countries. This lack of fiscal alignment could lead to imbalances in the economy and negatively affect trade if a common currency is established.

Brazil Inflation Rate:

The Greek Experience

Greece's experience with high inflation and joining the eurozone offers a cautionary tale for countries considering a joint currency. Despite its high inflation, Greece was able to meet the criteria for joining the eurozone and adopting the euro as its currency.

However, the decision had long-term consequences for Greece. The country was forced to give up control over its monetary policy, making it unable to respond to economic shocks. Greece's high inflation made its goods relatively expensive compared to other eurozone countries, making it difficult for Greek businesses to compete. Greece's inability to devalue its currency or lower interest rates during the global financial crisis left it with few options to address its economic problems, leading to austerity measures and massive debt.

Budget Deficits

Argentina and Brazil have similar ratios of deficit to GDP, but the deficits are both as high as 4.5% in 2021, indicating a lack of fiscal discipline and stability, which could negatively impact the viability of a common currency.

Autonomy of Central Banks

Argentina and Brazil have autonomous central banks, which play a critical role in maintaining the stability of their domestic currencies. A common currency would require a significant loss of autonomy for both central banks, reducing their ability to respond to economic shocks and maintain stability in their respective economies. For example, Portugal faced difficulties when it joined the eurozone and its central bank was forced to follow the European Central Bank's monetary policy, which resulted in high interest rates that made it difficult for Portuguese businesses to borrow money.

3. Interoperability

The comparison of blockchains to countries offers a thought-provoking perspective on the challenges of interoperability in the blockchain space. Just as each country has its own distinct culture, values, and governance system, each blockchain has its own unique protocols and features. This diversity among blockchains can result in difficulties in achieving interoperability, much like the difficulties that arise from differences in languages and currencies between countries.

For the blockchain ecosystem to reach its full potential, it is imperative that blockchains find ways to interact and cooperate with each other. Interoperability is a crucial factor in driving the growth and development of the blockchain world, just as cross-border trade and cooperation are vital for the growth of the global economy. A lack of interoperability can lead to fragmentation and inefficiencies, much like trade barriers and limited communication between countries can cause economic stagnation.

One possible solution to the challenge of interoperability is the use of cross-chain bridges. These bridges serve as a connection between different blockchains, enabling the transfer of assets and information in a similar manner to how transportation networks connect countries and support trade. In the blockchain sphere, cross-chain bridges play a significant role in linking different blockchains and allowing for a seamless flow of information and assets.

However, just as countries must approach international agreements with caution, blockchains must also exercise caution when choosing to interact with each other. Interoperability can also introduce security risks, such as cross-chain attacks, and it is imperative that blockchains assess the security and trustworthiness of other blockchains before engaging in interoperability.

Integration of Blockchains

A blockchain merger involves the combination of the protocols, systems, and networks of two or more existing blockchains into one. The objective is to create a more robust, efficient, and interoperable blockchain system that can offer improved features and capabilities.

However, merging blockchains is a complex and challenging process that requires significant technical, legal, and regulatory considerations. It involves the integration of different technologies, governance structures, and communities, which can be difficult to align. Additionally, the success of a merger also depends on the willingness and cooperation of the stakeholders involved, including the developers, users, and investors of the merging blockchains. Just as a country’s economic integration depends on the compatibility and alignment of its monetary policies, labor markets, and legal frameworks.

The success of Ethereum’s Merge highlights the importance of community alignment in achieving such a complex feat. The smooth transition to Proof of Stake was a testament to the strong leadership and vision of the Ethereum community, and that despite countless technical difficulties, integration is still possible.

4. Could It Be Launched as a CBDC?

Central Bank Digital Currencies (CBDCs) offer unique features that could make them a suitable fit for a common currency.

One of the key advantages of CBDCs is their ability to provide a secure and efficient means of cross-border transactions. CBDCs leverage the technology of blockchain to allow for fast digital transfers without the need for intermediaries, thereby reducing transaction time and costs. Additionally, CBDCs have the potential to increase financial inclusion as they can be easily accessed and used by a wider range of people, including those without access to traditional banking services.

Another advantage of CBDCs is their potential for improved transparency and accountability. CBDCs enable the tracking and recording of transactions in a secure and transparent manner, reducing the risk of fraud and money laundering, and making it easier to monitor and manage the economy. Additionally, the central bank's control over the issuance and management of CBDCs can provide greater stability, reducing the risk of market fluctuations and currency devaluation.

However, the successful implementation of a CBDC as a common currency also requires a high level of coordination and collaboration between the central banks and governments of Argentina and Brazil. This may prove challenging, given the differing monetary policies and economic systems of the two countries. The high political instability, the increasing social discomfort, and the rise of extreme leaderships seen in both countries in recent years don’t create the best scenario for coordination.

5. Conclusion

A common currency between Argentina and Brazil is not a viable solution due to their incompatible economies, differences in trading structures, lack of fiscal coordination, and the autonomy of central banks. The proposal lacks a deep understanding of the complexities of currency unions and the requirement for close economic and trade links between participating countries. Before embarking on such a significant undertaking, both countries must consider the potential risks and challenges.

Regarding CBDCs, they offer unique features and advantages such as improved security and efficiency in cross-border transactions, increased financial inclusion, and improved transparency and accountability. However, their successful implementation requires many characteristics that are not present in these countries.