Market Commentary

This week, China took unprecedented policy actions to support its onshore financial markets. On Tuesday, Chinese Central Bank Governor announced a 50 basis point cut in the reserve requirement ratio (RRR), injecting ~1 trillion yuan ($141.81 billion) worth of long-term liquidity into their financial market. The PBOC also reduced their 7-day repo rate and mortgage rates to lower borrowing costs.

On Thursday, they announced a massive fiscal stimulus of 2 trillion yuan in special bonds, with the first 1 trillion yuan package aimed at stimulating domestic consumption and production, and the second 1 trillion package to address local government debt issues later this year. Risk assets have reacted positively to these liquidity inflows, with Chinese and Hong Kong equity indices rallying and BTC testing $65,000.

In the US, Presidential Candidate Harris announced her commitment to prioritizing AI and digital assets as key pillars of her presidential campaign. This shift towards a pro-crypto stance removes a significant headwind for the industry, with both Presidential candidates potentially acting beneficially towards the crypto ecosystem.

“It’s well understood that U.S. monetary policy substantially impacts crypto prices, but the extent that this is also true of central bank policy in other major economies is perhaps less appreciated. China remains an enormous market for crypto and the RRR cut and fiscal stimulus are quite bullish for our risk-on asset class.” – Matthew Graham, managing partner.

Bitcoin futures open interest has been steadily increasing since the lows of $28 billion in early September, currently standing at $35 billion, just shy of this year’s all-time high figure of $39 billion in late March 2024.

We look forward to today’s Personal Consumption Expenditures (PCE) print as guidance for upcoming FOMC rate cuts. Muted inflation numbers will pave the way for Powell to continue supporting the US economy with further rate cuts.

Key News and Events

Stablecoins: The Hottest Web3 Vertical With High Growth and Competition

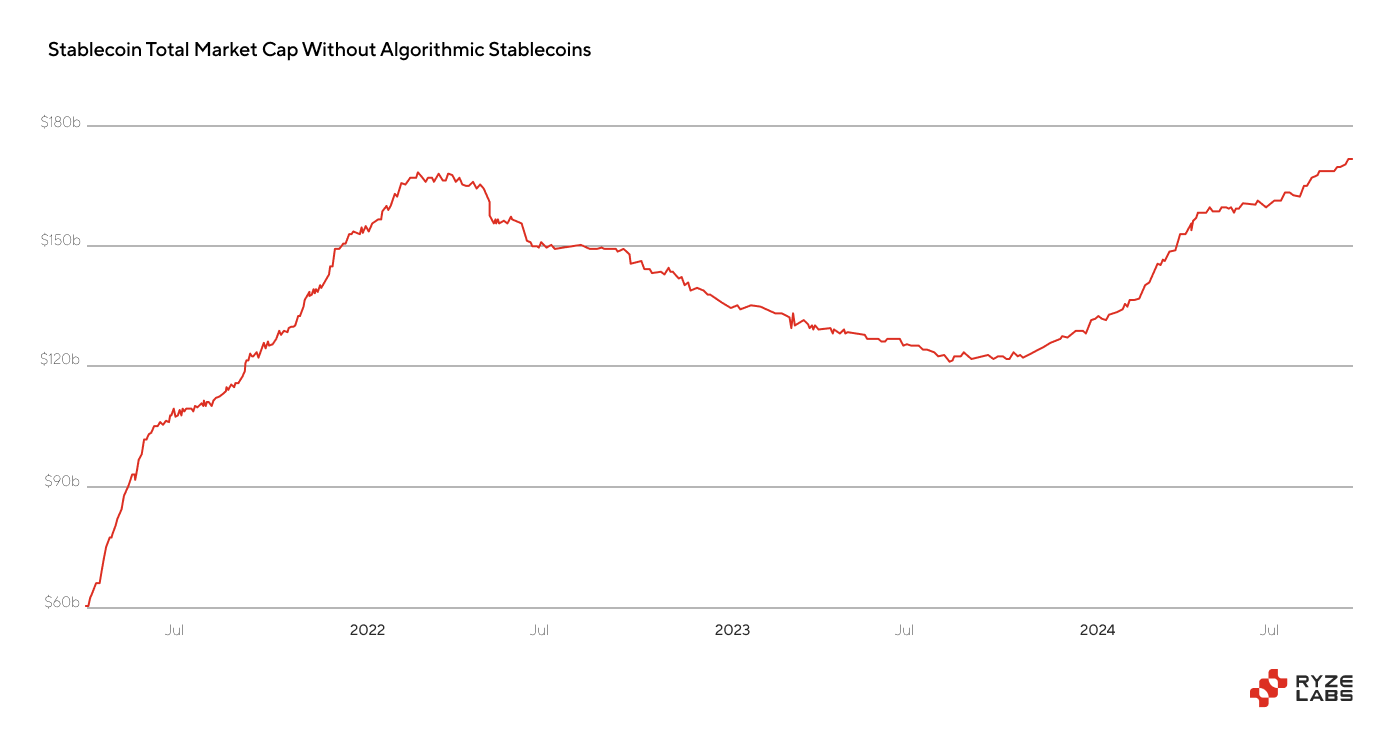

For the first time ever, the total stablecoin supply surpassed $170 billion (excluding algorithmic stablecoins). USDT and USDC continue to lead the market, but Ondo's USDY stablecoin has shown an impressive 21% monthly growth, highlighting the increasing competition in the space.

USDe, a synthetic dollar stablecoin, launched in February and has since climbed to become the fifth-largest stablecoin by market cap, with a circulating supply of $2.6 billion.

At Token2049, Circle announced the launch of its native USDC on Sui, which has already attracted over $50 million in inflows over the last 10 days.

The market cap of USDT on TON has grown by 41% over the last month and surpassed one billion dollars in circulating supply. Tether and TON collaborated last April 2024, issuing 60 million USDT to introduce USDT natively on The Open Network for the 900 million Telegram users. In just five months, USDT supply on TON has increased to over one billion dollars, potentially challenging Tron's dominance in terms of volume transferred.

“At this point, the evidence is incontrovertible that stablecoins are ‘full stop’ one of the biggest PMF success stories in modern fintech history. And it’s a story that’s pegged to the greenback. Given crypto’s continued growth trajectory we are only just beginning to realize the enormous implications of the dollar as lingua franca of the digital world.” – Matthew Graham, managing partner.

Ethena Expands Stablecoin Offerings with BlackRock-Backed UStb

Ethena Labs has announced its latest offering, UStb, a new stablecoin backed by BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) and tokenized by Securitize. UStb is designed to function like traditional stablecoins but with a key distinction: its reserves will be invested in BlackRock's BUIDL, a tokenized investment on the Ethereum blockchain primarily investing in U.S. dollars, short-term U.S. Treasury bills, and repurchase agreements.

BlackRock's BUIDL fund, launched in March 2023, has quickly grown to manage over $522 million in assets under management, becoming the largest tokenized U.S. Treasury fund, demonstrating the growing demand for tokenized government securities.

UStb stands out from Ethena's existing stablecoin, USDe, which is backed by derivative strategies rather than direct fiat reserves. USDe has performed well in recent months, maintaining its peg during market volatility. Ethena has designed its governance structure to allow flexibility between the two products. In the event of negative funding rate environments, the platform can reallocate backing assets from USDe to UStb, providing additional risk management measures.

Ethena plans to offer UStb as an additional form of collateral on centralized exchanges, expanding beyond current integrations with platforms like Bybit and Bitget. This approach gives exchange partners a choice between two stablecoin products for margin collateral, offering distinct risk profiles tailored to different market conditions.

“With its proven technology and brand name, Ethereum continues to be the first home for institutional crypto products. Many in the industry hold the opinion that this will hold true long into the future. We disagree. Watch for Solana to start chipping away at Ethereum’s institutional mindshare. The technology is simply better.” – Matthew Graham, managing partner.

The stablecoin market continues to be highly lucrative, driven by increasing demand for secure, liquid assets. Tether’s Q2 2024 report, which posted a record $5.2 billion in profit, underscores the financial potential of these assets. However, this sector is ripe for disruption, as new entrants like Ethena Labs introduce alternative stablecoin models like UStb, offering distinct features and risk profiles. As the market evolves, there is growing room for innovation and competition, positioning stablecoins as a key area where emerging players can challenge the dominance of established leaders.