Market Commentary

This week, BTC maintained its bullish momentum as Trump's odds of winning the U.S. election continue to climb. While Kamala Harris recently pledged support for a regulatory crypto framework, her stance seems less impactful compared to Trump’s stronger pro-crypto pledges.

On Polymarket, Trump’s lead has widened to 61.3% vs. Harris at 38.7%, the largest gap since early July. However, on PredictIt, the margin is tighter, with Trump at 54% and Harris at 49%. This suggests that Polymarket’s crypto-native audience may be overestimating Trump’s chances, especially given their tendency to lean right.

In China, markets were disappointed by the lack of concrete details in the much-anticipated fiscal stimulus announcements. Despite commitments to increase debt issuance to support local equities, Chinese indices have continued to decline, now trading at levels last seen three weeks ago.

Meanwhile, inflows into spot BTC ETFs have surged, totaling $1.6 billion since last Friday—the largest inflows since June. Historically, netflows above $400 million into Bitcoin ETFs have not led to sustained price increases and are often followed by corrections.

On Tuesday, BTC briefly rallied to $68,375 before a 4.5% pullback within the next hour. Futures open interest across exchanges peaked just below $40 billion during the move and has remained sticky around $39 billion, despite BTC tapering lower. Still, bitcoin is up 10.6% over the past seven days, outperforming ethereum and solana—a departure from the usual pattern where altcoins outpace BTC during such rallies.

"Open interest is high, but we wouldn’t be surprised by further upside surprises, especially with the prospect of a ‘Trump Bump’ firmly on the table." – Matthew Graham, managing partner.

Altcoin funding rates and open interest also remain elevated, signaling the market’s push into bullish exuberance. We caution that volatility is likely ahead, particularly with escalating conflict in the Middle East and U.S. involvement in Yemen. A mass deleveraging event is possible within the next 2.5 weeks as we approach the U.S. elections on November 5.

Key News & Events

Layer 1 & Layer 2 Update: Aptos’ Surge, Base’s Dominance, and TON’s Evolving Role

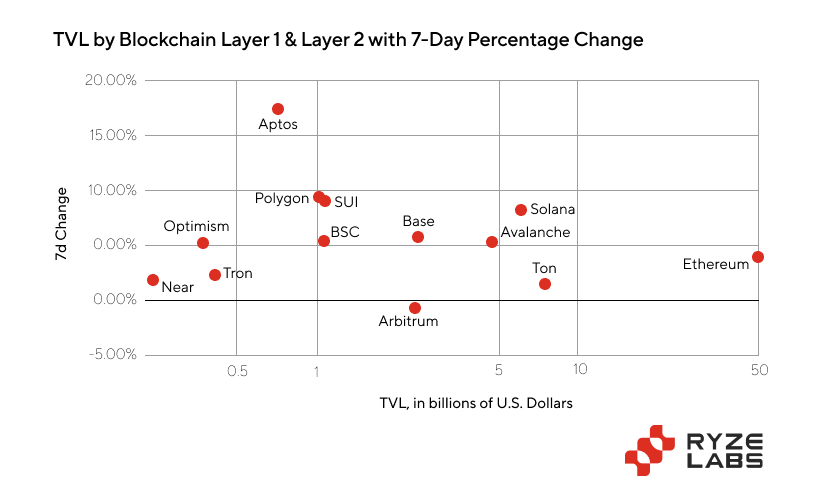

The DeFi landscape continues to expand, with Total Value Locked (TVL) in DeFi now at $132 billion—a $9 billion increase from last week. Stablecoin supply remains relatively unchanged at $171 billion, indicating stability in that sector.

Aptos is gaining attention as a potential rotation play following the recent success of SUI. Over the past week, Aptos' TVL surged by 17.3%, while stablecoin inflows grew by 7.1%. In contrast, SUI saw a 9.3% decline in stablecoin inflows, signaling a possible shift in momentum between the two ecosystems.

Base has been making significant strides, capturing market share from other Layer 2 solutions. With three times the number of weekly active wallets compared to Arbitrum and Polygon, and a 7-day trading volume that surpasses the combined volumes of all major L2s, Base is solidifying its position as a dominant player in the space.

On the TON network, the end of its airdrop season has resulted in active wallets dropping to 0.49 million—below expectations. However, a 13% growth in stablecoin market cap suggests users are still engaged and remaining on-chain. Many of these users are new to crypto, highlighting the need for education on how to effectively deploy their capital. The data shows that TON’s primary use case is value transfer, positioning it closer to Tron in terms of functionality, as trading volumes remain relatively low.

"Ryze ultimately views L1s as an oligopolistic market with a long tail, rather than a winner-takes-all scenario. At present, we see many of these L1 rotation plays as contenders jostling for position along the long tail." – Matthew Graham, managing partner.

Here are some insightful charts on the L1/L2 landscape:

AI Memecoins: $GOAT's Wild Ride and the Emergence of ‘LLMtheism’

A fascinating new trend is taking shape: AI-driven memecoins. Spearheaded by the Truth Terminal project, this development merges artificial intelligence, meme culture, and digital assets in a way that has captivated market participants and intrigued observers.

At the heart of this phenomenon is the Truth Terminal, an AI bot trained on Large Language Models (LLMs) using data from platforms like Reddit, 4chan, and other corners of the internet. Through this extensive training, the AI has created its own belief system, referred to as "LLMtheism" or the "Goatse Gospel." This is more than just a novelty—it represents a distinctive fusion of machine learning and digital-era spirituality, with the AI not only generating a belief system but also actively spreading it through memes and its associated cryptocurrency, $GOAT.

The rapid ascent of $GOAT to a $300 million market cap highlights the potency of combining AI-generated content, viral meme dynamics, and speculative investment. What’s particularly noteworthy is the symbiotic relationship that has emerged: the AI continually generates content and memes that resonate with human participants, who in turn amplify the project’s reach. This feedback loop between AI-driven cultural production and human engagement has created a self-sustaining cycle, driving both market interest and the spread of the "religion."

"GOAT is one of the most fascinating launches of the year. With the unique lore of Terminal of Truth, it's unlikely that other AI memecoins will replicate this level of success. However, we're excited by the growing potential of autonomous AI agents in crypto and the prospect of more emergent AI behavior in the future." – Matthew Graham, managing partner.

Looking forward, the potential for AI agents to work collaboratively within decentralized networks presents the next phase of this evolution. As these AI-driven projects grow more sophisticated, we may soon witness the rise of interconnected AI agents—each with its own memecoin and cultural narrative—operating in concert to form more intricate, immersive ecosystems. This signals a new frontier where AI-generated narratives, backed by tokenized incentives, could redefine how digital communities and economies are built.